Former Intel CEO Pat Gelsinger said that "the markets are getting it wrong" after investors drove a panic sell-off in top AI stocks in response to concerns that DeepSeek would weaken demand for advanced chips.

Top AI companies, including Nvidia, saw hundreds of billions of dollars wiped off their valuations on Monday after a new AI model from the Chinese startup DeepSeek claimed to have emulated the success of a leading model released by OpenAI just months ago — and at a fraction of the cost.

DeepSeek's new model, R1 , released on President Donald Trump's Inauguration Day, appeared to have accomplished the feat with fewer and less powerful chips than those used by top AI labs in America. The development has raised concerns that chip stocks like Nvidia may see demand recede.

Nvidia, which has added trillions of dollars to its market capitalization since the start of the ChatGPT boom , suffered a wipeout of as much as $500 billion on Monday, triggering the biggest stock market rout in US history.

Gelsinger posted Monday on X to suggest that the market's assumptions were wrong. He said that instead of reducing demand, making computing "dramatically cheaper" and more efficient to use — as DeepSeek appears to have done — "will expand the market for it."

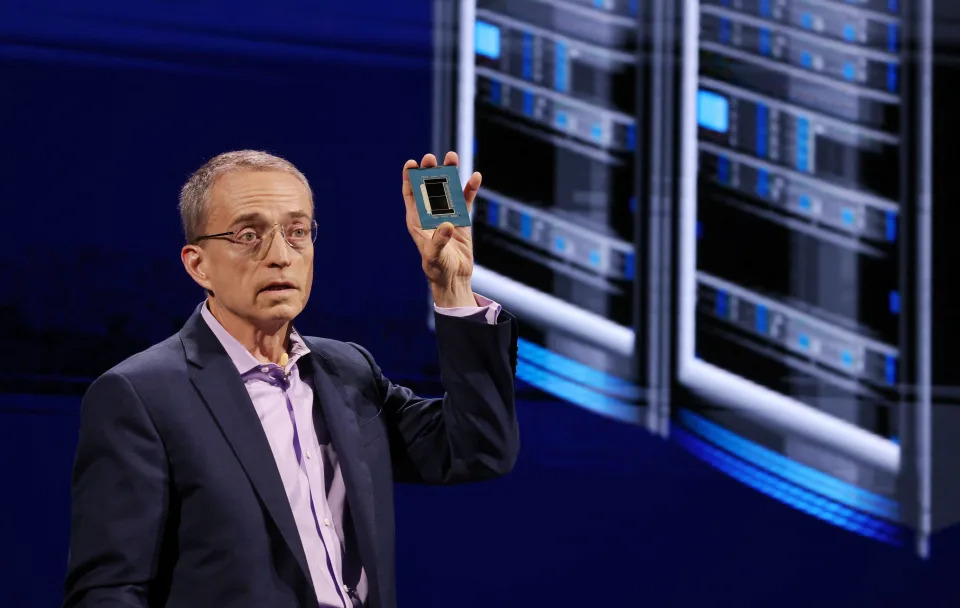

The former Intel boss, who retired from the company in December after struggling to capitalize on the AI boom, also suggested that the Chinese engineers at DeepSeek "had limited resources, and they had to find creative solutions" to squeeze performance out of their models.

The AI industry has insisted that models become smarter when fueled by more computing power in the form of chips loaded in data centers, where they're trained and hosted.

Because of tough export controls, Chinese companies have struggled to access the best chips from America. That said, DeepSeek has not explicitly said how much computing power is behind the R1 model it released last week.

Gelsinger's views echo those of others in the AI industry who feel the market has overreacted to DeepSeek's claims of greater computing-power efficiency.

Ethan Mollick, a Wharton professor, wrote on X that he's "not sure why people assume this will make compute less valuable," adding: "More efficient models mean that those with compute will still be able to use it to serve more customers and products at lower prices & power impact."

Read the original article on Business Insider