The March natural gas contract has been on a rollercoaster ride over the past month, driven by several factors, including polar vortex blasts across the Lower 48, trade tensions, rising artificial intelligence-related energy demand under the "Powering Up America" theme , and surging liquefied natural gas (LNG) exports. This heightened volatility reflects how traders are uncertain about price direction ahead of the spring months.

Bloomberg calculations based on 60-day volatility show that the March contract for NatGas has blown out to the widest level ever over what Bloomberg's Elizabeth Elkin pointed out are traders " trying to figure out the direction for gas as LNG exports, increasing demand for gas-fired electricity to run data centers and the threat of tariffs are emerging as potential fundamental movers in a market typically dominated by weather fluctuation s."

Elkin added, "To cap it off, forecasts have swung widely over the last few weeks, making it difficult to predict how high demand will be to heat homes and businesses."

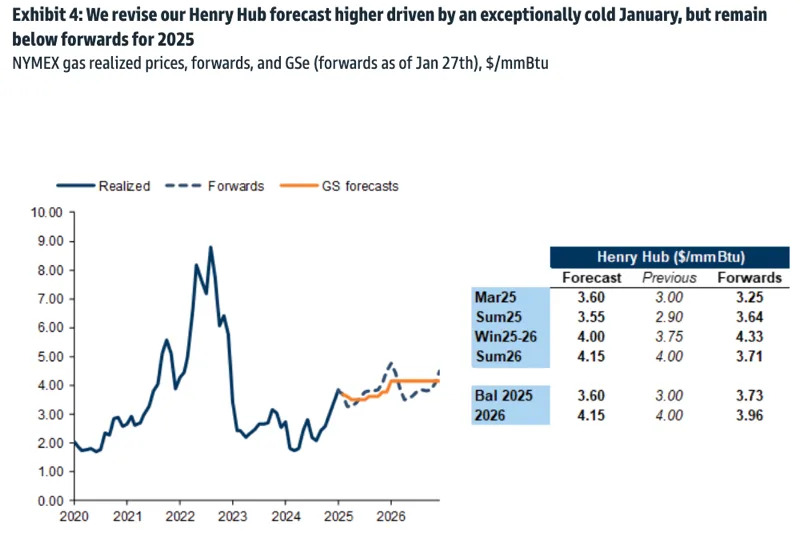

For color on possible direction , Goldman's Samantha Dart told clients early last week that she shifted her US NatGas price forecast from $3/mmBtu to $3.6 "to reflect tighter balances."

Dart also noted: "We see further upside to 2026 US gas prices."

By Zerohedge.com

More Top Reads From Oilprice.com

Read this article on OilPrice.com