Commercial vehicle retailer Rush Enterprises (NASDAQ:RUSH.A) reported Q4 CY2024 results exceeding the market’s revenue expectations , but sales were flat year on year at $2.01 billion. Its GAAP profit of $0.91 per share was 9% above analysts’ consensus estimates.

Is now the time to buy Rush Enterprises? Find out in our full research report .

Rush Enterprises (RUSHA) Q4 CY2024 Highlights:

“Despite the persistent headwinds the industry faced in 2024, I am proud of the financial results our team delivered,” said W.M. “Rusty” Rush, Chairman, Chief Executive Officer and President of Rush Enterprises,

Company Overview

Headquartered in Texas, Rush Enterprises (NASDAQ:RUSH.A) provides truck-related services and solutions, including sales, leasing, parts, and maintenance for commercial vehicles.

Vehicle Parts Distributors

Supply chain and inventory management are themes that grew in focus after COVID wreaked havoc on the global movement of raw materials and components. Transportation parts distributors that boast reliable selection in sometimes specialized areas combined and quickly deliver products to customers can benefit from this theme. Additionally, distributors who earn meaningful revenue streams from aftermarket products can enjoy more steady top-line trends and higher margins. But like the broader industrials sector, transportation parts distributors are also at the whim of economic cycles that impact capital spending, transportation volumes, and demand for discretionary parts and components.

Sales Growth

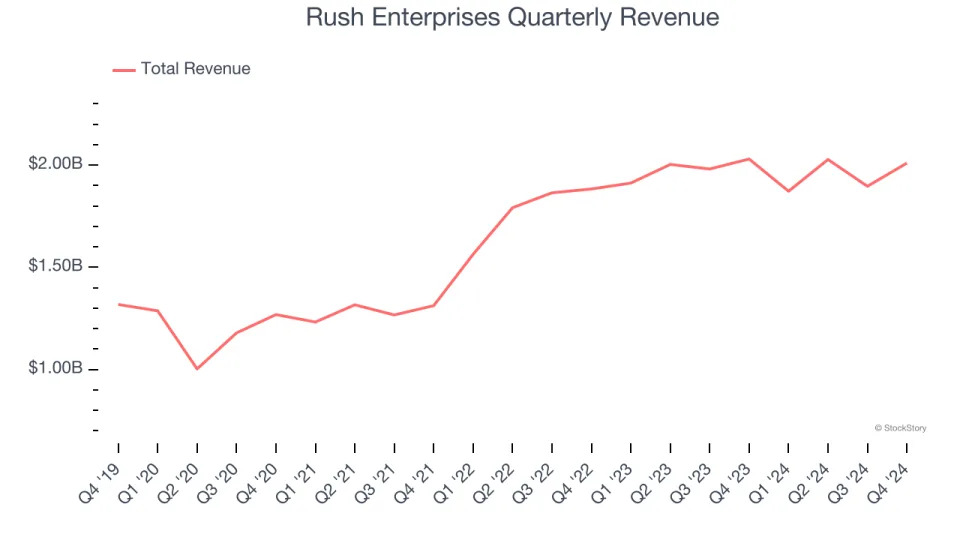

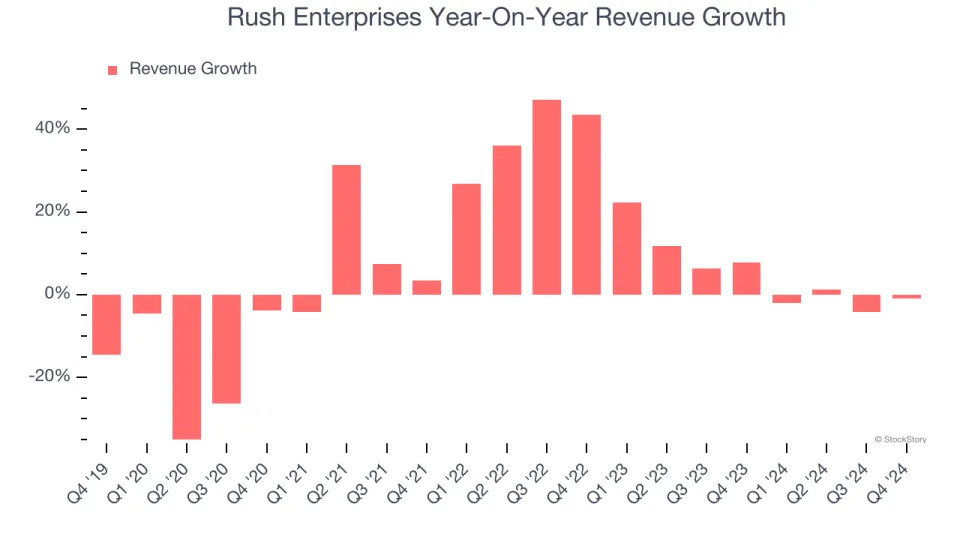

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Regrettably, Rush Enterprises’s sales grew at a mediocre 6.1% compounded annual growth rate over the last five years. This was below our standard for the industrials sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Rush Enterprises’s recent history shows its demand slowed as its annualized revenue growth of 4.8% over the last two years is below its five-year trend.

Rush Enterprises also breaks out the revenue for its most important segments, Vehicles and Aftermarket, which are 64.8% and 30.2% of revenue. Over the last two years, Rush Enterprises’s Vehicles revenue (new and used commercial trucks) averaged 6.5% year-on-year growth while its Aftermarket revenue (parts and services) averaged 3.3% growth.

This quarter, Rush Enterprises’s $2.01 billion of revenue was flat year on year but beat Wall Street’s estimates by 8.2%.

Looking ahead, sell-side analysts expect revenue to decline by 3% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. .

Operating Margin

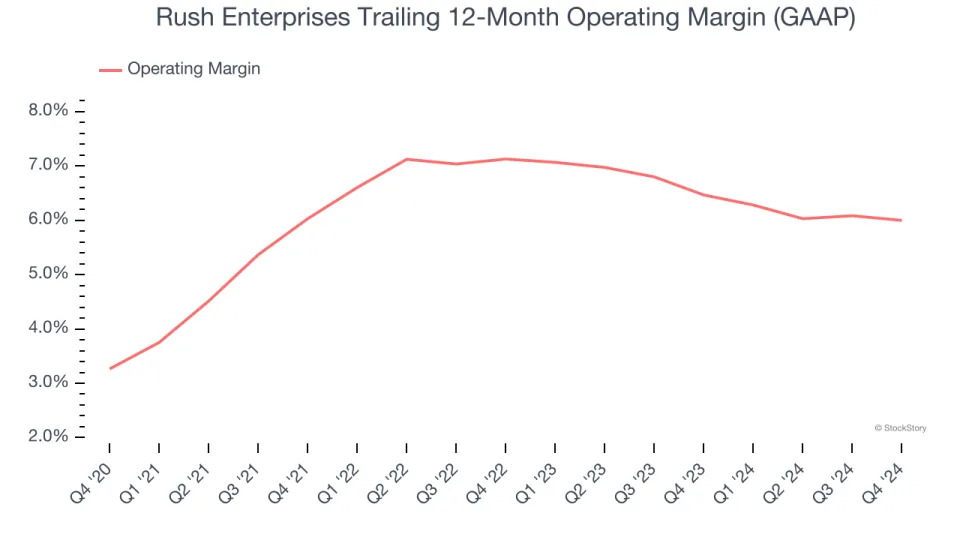

Rush Enterprises was profitable over the last five years but held back by its large cost base. Its average operating margin of 6% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, Rush Enterprises’s operating margin rose by 2.7 percentage points over the last five years.

In Q4, Rush Enterprises generated an operating profit margin of 5.6%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

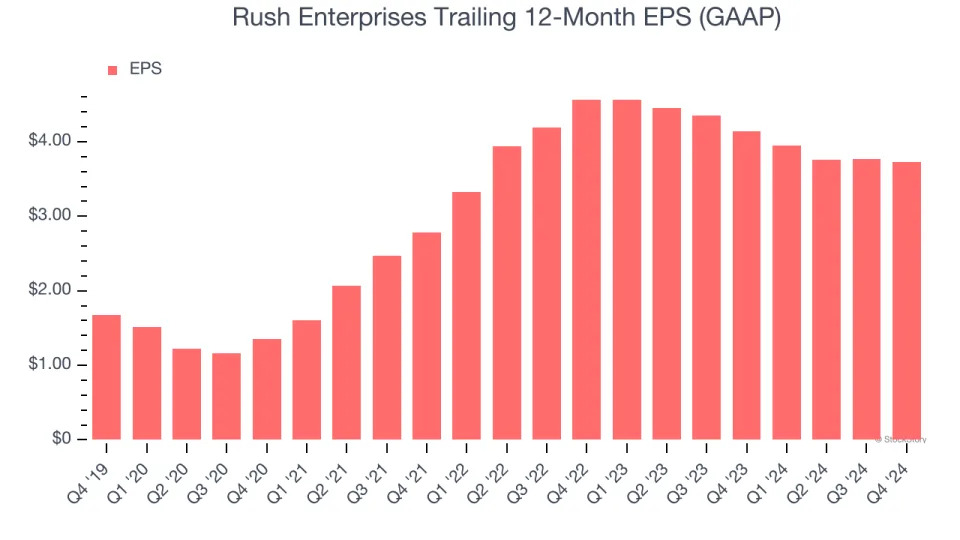

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

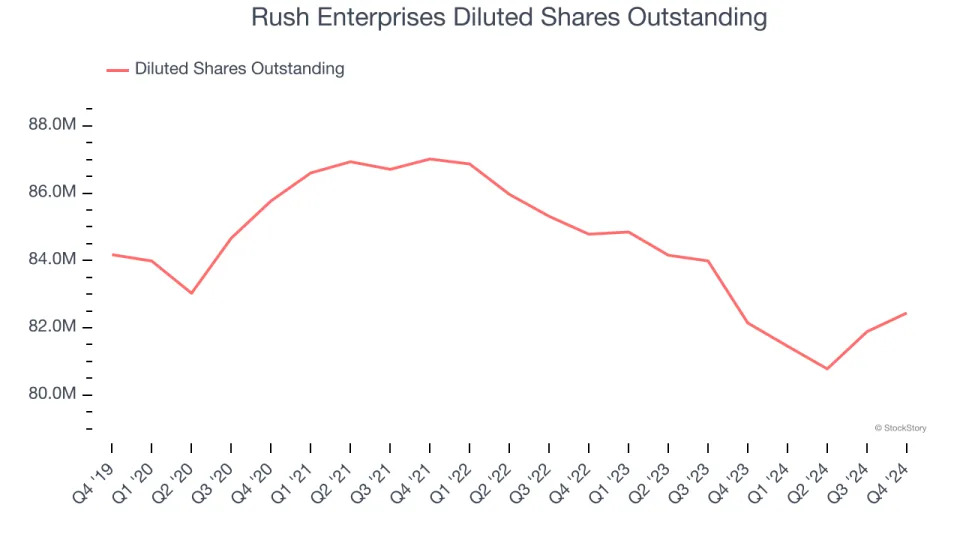

Rush Enterprises’s EPS grew at a spectacular 17.4% compounded annual growth rate over the last five years, higher than its 6.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into Rush Enterprises’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Rush Enterprises’s operating margin was flat this quarter but expanded by 2.7 percentage points over the last five years. On top of that, its share count shrank by 2.1%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Rush Enterprises, its two-year annual EPS declines of 9.6% mark a reversal from its (seemingly) healthy five-year trend. We hope Rush Enterprises can return to earnings growth in the future.

In Q4, Rush Enterprises reported EPS at $0.91, down from $0.95 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 9%. Over the next 12 months, Wall Street expects Rush Enterprises’s full-year EPS of $3.73 to grow 4%.

Key Takeaways from Rush Enterprises’s Q4 Results

It was great to see Rush Enterprises beat past analysts’ revenue and EPS expectations this quarter. Zooming out, we think this was a solid quarter. The stock remained flat at $61.17 immediately following the results.

Is Rush Enterprises an attractive investment opportunity at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free .