Secondhand luxury marketplace The RealReal (NASDAQ: REAL) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 14.4% year on year to $164 million. The company expects next quarter’s revenue to be around $159 million, close to analysts’ estimates. Its non-GAAP loss of $0.01 per share was in line with analysts’ consensus estimates.

Is now the time to buy The RealReal? Find out in our full research report .

The RealReal (REAL) Q4 CY2024 Highlights:

“We achieved strong fourth quarter and full year 2024 results, exiting the year from a position of strength," said Rati Levesque, President and Chief Executive Officer of The RealReal.

Company Overview

Founded by consignment store aficionado Julie Wainwright, The RealReal (NASDAQ: REAL) is an online marketplace for buying and selling secondhand luxury goods.

Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

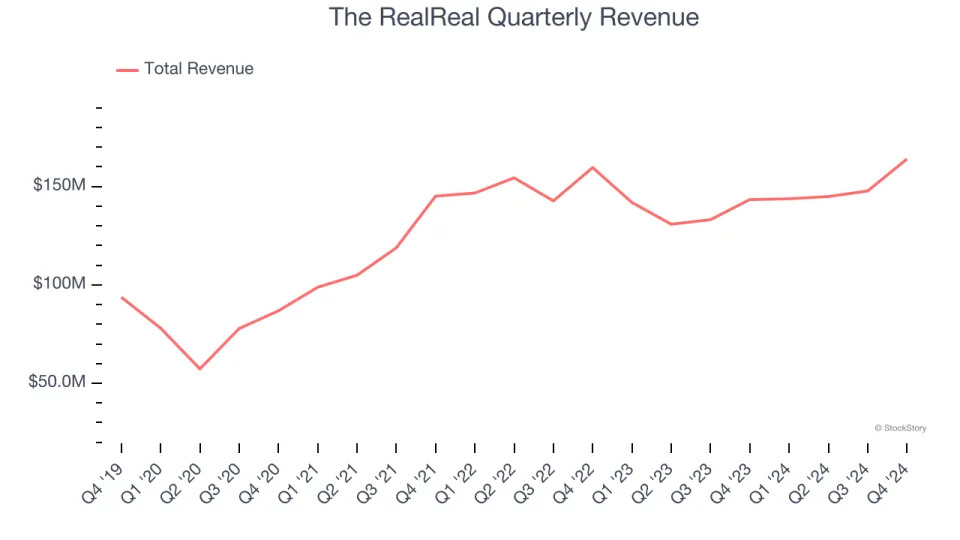

Sales Growth

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Unfortunately, The RealReal’s 8.7% annualized revenue growth over the last three years was mediocre. This was below our standard for the consumer internet sector and is a poor baseline for our analysis.

This quarter, The RealReal’s year-on-year revenue growth was 14.4%, and its $164 million of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 10.6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 9.5% over the next 12 months, similar to its three-year rate. This projection is underwhelming and indicates its newer products and services will not accelerate its top-line performance yet.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link .

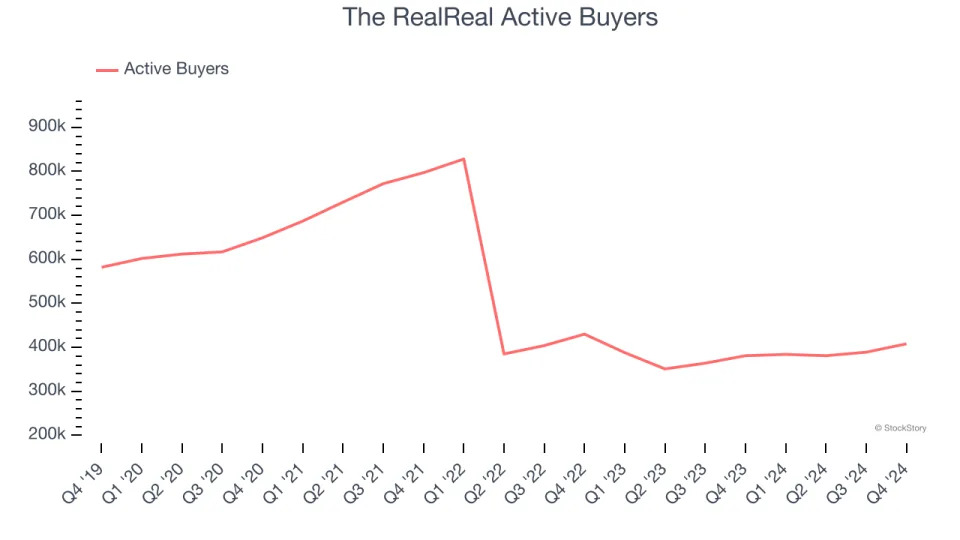

Active Buyers

User Growth

As an online marketplace, The RealReal generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

The RealReal struggled to engage its audience over the last two years as its active buyers have declined by 7.7% annually to 408,000 in the latest quarter. This performance isn't ideal because internet usage is secular, meaning there are typically unaddressed market opportunities. If The RealReal wants to accelerate growth, it likely needs to enhance the appeal of its current offerings or innovate with new products.

Luckily, The RealReal added 27,000 active buyers in Q4, leading to 7.1% year-on-year growth. The quarterly print was higher than its two-year result, suggesting its new initiatives are accelerating user growth.

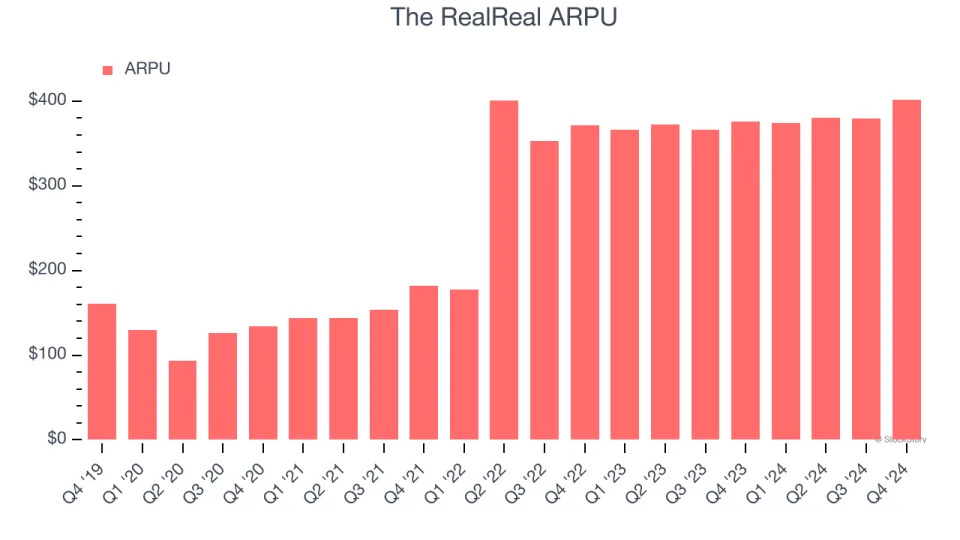

Revenue Per User

Average revenue per user (ARPU) is a critical metric to track for online marketplace businesses like The RealReal because it measures how much the company earns in transaction fees from each user. ARPU also gives us unique insights into a user’s average order size and The RealReal’s take rate, or "cut", on each order.

The RealReal’s ARPU growth has been exceptional over the last two years, averaging 14.9%. Although its active buyers shrank during this time, the company’s ability to successfully increase monetization demonstrates its platform’s value for existing users.

This quarter, The RealReal’s ARPU clocked in at $401.95. It grew by 6.8% year on year, mirroring the performance of its active buyers .

Key Takeaways from The RealReal’s Q4 Results

We were impressed by how significantly The RealReal blew past analysts’ EBITDA expectations this quarter. On the other hand, its full-year EBITDA guidance missed significantly and its number of active buyers fell slightly short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 3.3% to $7.70 immediately after reporting.

The RealReal’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free .