Key Takeaways

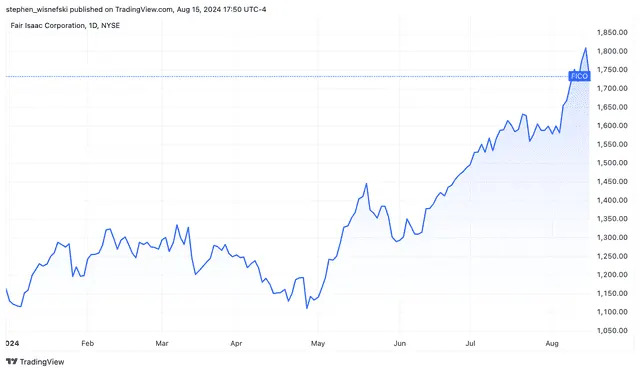

Shares of Fair Isaac Corp. ( FICO ), the financial analytics firm known for its credit scores, receded from an all-time high, tumbling 4.2% to log the weakest daily performance of any stock in the S&P 500.

The daily loss followed filings with the Securities and Exchange Commission (SEC) disclosing that two key FICO executives have sold shares in the company.

Company Leaders Cash Out FICO Shares

SEC filings on Tuesday and Wednesday revealed several company insiders trimming their position in the stock.

Steven Weber, Fair Isaac's chief financial officer, sold 1,800 shares for a total value of more than $3 million in a transaction on Aug. 9. Then, in a sale dated Aug. 12, Executive Vice President Thomas Bowers unloaded 3,000 shares worth more than $5 million.

To help maintain transparency in the markets, any time there is a material change in the stock holdings of a company insider, the firm must file SEC Form 4 within two business days of the transaction. When executives sell shares of their own company, investors often interpret it as a lack of confidence in the company's upcoming performance.

Selling Follows Post-Earnings Bump

FICO released its latest earnings report two weeks ago, with earnings per share (EPS) falling slightly short of estimates for its fiscal third quarter of 2024 but revenue topping forecasts. Sales in the company's "scores" division, which includes its business-to-business and business-to-consumer solutions, grew 20% year over year. FICO also raised its full-year sales and profit outlook.

The stock closed at $1,600 per share heading into the earnings release on the final day of July, but it began to march higher in August, reaching an all-time closing high above $1,800 on Aug. 14.

The decline on Thursday marked a retreat from that record. Even after the down day, FICO shares are still up nearly 50% in 2024.

TradingView

Read the original article on Investopedia .