The digital assets industry is now a full-blown political issue, and Wall Street firms with crypto exposure are staying cautious ahead of November's U.S. election.

Whether the next election will result in Donald Trump or Kamala Harris occupying the Oval Office for the next four years, one thing Wall Street firms agree on is that either nominee will bring crypto regulation forward.

Former President Donald Trump has recently begun courting the crypto industry, promising to install friendly regulators and suggesting the U.S. maintain a Bitcoin reserve during last month's BTC Nashville conference. He also promised to fire the chair of the Securities and Exchange Commission (SEC), Gary Gensler, though it's unclear how he'd do that .

Democratic nominee Kamala Harris, on the other hand, has so far been quiet on the issue.

“Although she has yet to make her position on crypto clear, her past affiliations suggest a potentially cautious approach,” CoinShares analyst Max Shannon wrote in a report.

Two Wall Street firms who are issuers of both spot bitcoin {{BTC}} and spot ether {{ETH}} exchange-traded funds (ETFs) – VanEck and 21Shares – are betting on a Trump administration to take office in January. Both firms have filed to introduce a spot Solana {{SOL}} ETF in the U.S. and are waiting for SEC's approval.

“Based on what we’ve seen so far about possible personnel appointments, a Harris Presidency might be even worse for US-based digital asset entrepreneurs than Biden,” said Matthew Sigel, head of digital asset research at VanEck.

“That this administration is winning antitrust lawsuits against Big Tech while attacking open-source alternatives is illogical and fails to protect the consumer welfare that regulators are entrusted with safeguarding,” he said.

As the vice president to President Joe Biden, Harris is often associated with her party’s current stance and enforcement actions against cryptocurrencies. However, many Democrats have shown signs that they disagree with their president, for example when 32 of them joined Republicans in supporting a bill that would rethink how the SEC views digital assets.

'Real issue'

As with any campaign promise made by politicians, it is unclear whether Harris will form a positive or negative stance regarding the industry and whether Trump will follow through on his promises.

“A more balanced approach to crypto could set Vice President Harris apart from the Biden administration’s more critical stance, aligning her with Democrats who are advocating for positive crypto legislation,” CoinShares’ Shannon argued.

Wall Street asset management giant Franklin Templeton says there are constructive signals from both sides on what the future holds.

“One thing that’s clear is that crypto seems to be at a scale and importance level where it is a real issue in politics nowadays, you can’t just sweep it under the rug, and that is exciting to see,” said Christopher Jensen, head of digital assets at Franklin.

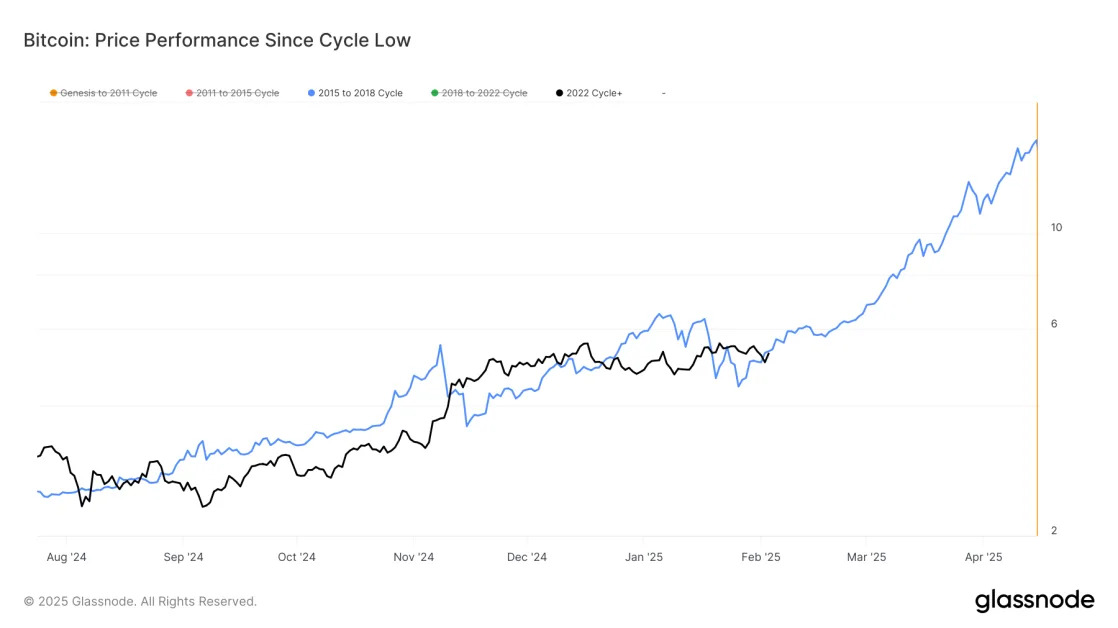

A report from brokerage firm Bernstein on Tuesday said that market sentiment suggests that a second term for Trump would be bullish for crypto markets whereas a Harris win would bearish.

The reason behind this assessment is the weakness in the price of bitcoin following the shift in odds on crypto-based prediction platform Polymarket in favor of Harris. Bettors on the website currently predict a 53% chance of Harris winning the election in November while Trump’s odds stand at 45%.