Medications used for weight loss, such as Ozempic, Wegovy, Mounjaro, and Zepbound, are taking over the pharmaceutical industry. While Eli Lilly and Novo Nordisk are the big players in diabetes and obesity care thanks to their glucagon-like peptide-1 (GLP-1) agonists, there are a number of companies looking to dethrone the industry stalwarts.

For the most part, competitors are investing hefty sums into research and development to bring their own GLP-1 drugs to market.

One company that recently entered the weight loss space without a novel drug of its own is telemedicine company Hims & Hers Health (NYSE: HIMS) . Instead of manufacturing an alternative to existing treatments, Hims & Hers entered the weight loss race through the back door by offering patients compounded versions of Ozempic and its sibling treatments.

I see this strategy as not only controversial but also one that could very well spell big downside for the company.

What are compounded weight loss medications?

Have you ever been to a big city where vendors on the sidewalk are selling fake designer handbags and clothing that look identical to what's sold in a store?

The difference between these lower-cost alternatives and what's sold at a name-brand store is that these reproductions are likely made with lower-quality materials and may not last as long as the real thing. There's no big company backing the products with its deep pockets and its shiny brand name.

The concept of compounded medications is similar.

The primary compound in Ozempic and Wegovy is called semaglutide. Novo Nordisk owns a lot of intellectual property (IP) around the specific chemical makeup of semaglutide. This makes the drug nearly impossible to copy at a molecular level.

In the case of weight loss medications, compounded semaglutide may contain ingredients that are tested in research but never make it to the final FDA-approved version of a drug -- possibly for safety reasons.

The FDA notes: "Compounded drugs are not FDA-approved. This means that FDA does not verify the safety, effectiveness or quality of compounded drugs before they are marketed."

Why is Hims & Hers doing this?

Ozempic, Mounjaro, and their sibling treatments are expensive -- there's no doubt about that. Mainstream GLP-1 agonists can cost nearly $1,000 per month out of pocket if your healthcare insurance provider won't cover the cost.

According to the Hims & Hers website, the company's rationale behind offering compounded GLP-1 injections is to let customers have access to "medications with the same active ingredient as Ozempic® and Wegovy® without navigating the shortages and costs that are currently limiting access to the branded medications."

It's no secret that people will do out-of-the-ordinary things to lose weight. But with that said, I think Him & Hers is looking to bolster its business by capitalizing on a theme known as "body politics" as opposed to providing top-notch health care.

Saying that their compounded semaglutide contains the same active ingredient as Ozempic and Wegovy is sort of like wearing two different shoes but saying they are the same because both of them have shoelaces. Taking a compounded semaglutide is far from the equivalent of Ozempic or Wegovy and is very much an unregulated product.

And the shortages driving people to compounded GLP-1 agonists may not last forever. Earlier this year, Novo spent $16.5 billion to acquire several manufacturing facilities from Catalent . The entire rationale behind the deal was to augment its existing manufacturing capabilities and increase output for Ozempic and Wegovy.

Lilly followed this template with an acquisition of its own. Back in April, Lilly acquired an injectable medication facility from Nexus Pharmaceuticals to increase the supply of Mounjaro and Zepbound.

I caution investors not to buy into the idea that Hims & Hers is here to save the day because Eli Lilly and Novo Nordisk are failing to meet supply and demand dynamics.

Why I see downside ahead

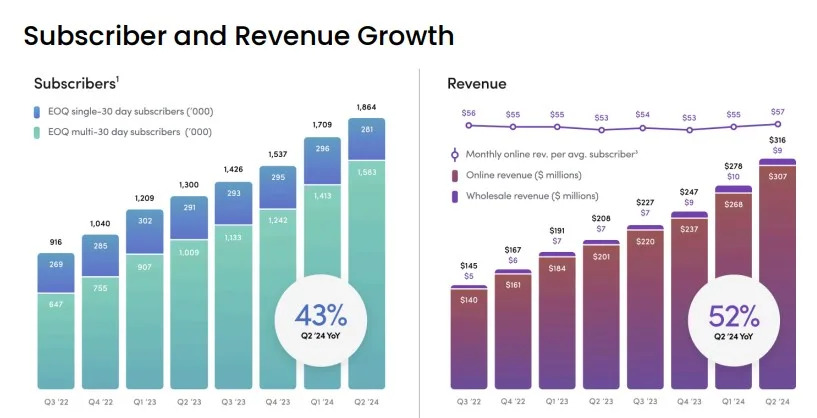

So far in 2024, Hims & Hers stock has risen 74%, handily outperforming the S&P 500 and Nasdaq Composite . I think these gains can mostly be attributed to impressive growth in the company's subscription business.

While the trends in the charts above indicate that Hims & Hers has been successful in acquiring and maintaining subscribers, I think the company's move into compounded semaglutide is going to backfire.

The FDA warns that a major risk surrounding compounded GLP-1's is dosing errors "from patients measuring and self-administering incorrect doses of the drug and healthcare providers miscalculating doses of the drug."

Should patients taking compounded semaglutide from Hims & Hers experience significant health issues, the company could end up at the center of a public relations nightmare and could very well face lawsuits or even fines administered by the Department of Justice (DOJ).

On the other hand, while both Lilly and Novo stocks have risen considerably over the last year, each company appears to have a robust long-term roadmap in front of it -- suggesting further gains could be on the horizon for patient investors.

More audacious investors may want to check out a number of alternatives to Lilly and Novo that are actually spending significant time and capital on drug development. But for now, I see too much risk with Hims & Hers and think the company just bit off more than it could chew at the expense of some potential near-term growth.

Investors looking for exposure to the weight loss space are best off considering positions in larger players with established footprints and avoiding speculative opportunities such as Hims & Hers.

Before you buy stock in Hims & Hers Health, consider this: