Super Micro Computer (NASDAQ: SMCI) announced fiscal 2024 fourth-quarter results (for the quarter ended June 30) on Aug. 6, and the stock fell 20% as investors were concerned about the company's shrinking margin profile.

Supermicro's revenue shot up remarkably year over year, and its guidance for fiscal 2025 indicates that its stunning growth is here to stay. What's more, management announced a 10-for-1 stock split , which will go into effect on Oct. 1. Still, the fact that the company's earnings of $6.25 per share missed analysts' expectations of $8.12 per share by a mile sent the stock packing .

Will a stock split help turn Supermicro stock's fortunes around?

A stock split is nothing more than a cosmetic move that doesn't alter a company's fundamentals. So, expecting Supermicro stock to surge on this announcement when it failed to live up to Wall Street's expectations won't be logical. A stock split simply increases the outstanding share count of a company by reducing the price of each share. Its market cap remains the same.

An investor holding one share of Supermicro now -- which is trading at around $510 -- will own 10 shares post-split, worth $51 each. There is a view that reducing the price of each share through a forward stock split makes stock ownership accessible to a wider pool of investors, thereby increasing demand for a company's shares.

Given that Supermicro stock was surging phenomenally until early 2024, there was a possibility that it could split its stock to reduce the price of each share. But as we have already discussed, a stock split won't have an impact on Supermicro's growth prospects and is unlikely to bring the stock out of the rut it is in (it has fallen 44% since the beginning of March).

However, a closer look at the company's latest results, guidance, and valuation will tell us that buying this company following its steep pullback could be a smart move. Here's why.

Supermicro's red-hot growth is here to stay

Supermicro finished fiscal 2024 with revenue of $14.94 billion and non-GAAP (generally accepted accounting principles) earnings of $22.09 per share. Its top line increased 110% on a year-over-year basis, while earnings were up 87%. However, the company -- known for manufacturing server and storage systems -- saw a contraction in its margins last quarter.

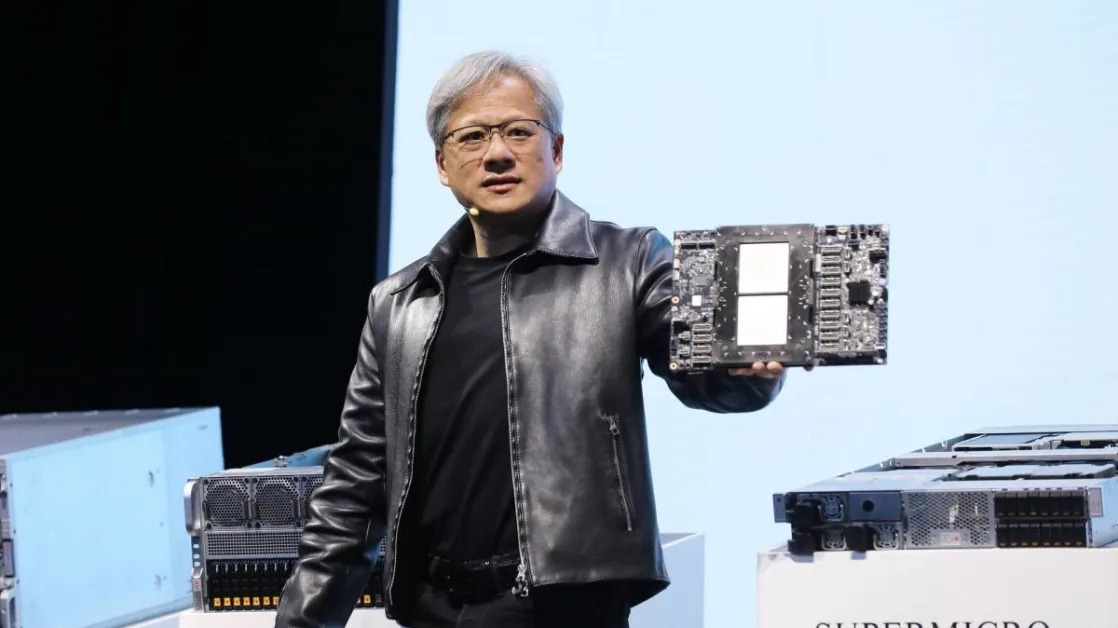

Supermicro's gross margin shrunk to 14.2% in fiscal 2024, from 18.1% in fiscal 2023. This margin pressure can be attributed to the investments that Supermicro is making to increase the manufacturing capacity of its artificial intelligence (AI) servers, which are in huge demand and driving terrific growth in its revenue. It is worth noting that 70% of Supermicro's revenue in the previous quarter was from sales of its server solutions used for deploying AI graphics processing units (GPUs).

Not surprisingly, Supermicro is increasing its production capacity so that it can capture a bigger share of the AI server market. For instance, Supermicro is aggressively scaling up the production of direct liquid cooling (DLC) servers. That's a smart thing to do, as the market for liquid-cooled servers is expected to be worth $21 billion in 2029 as compared to $5 billion this year, driven by their growing adoption in AI data centers that consume huge amounts of electricity and generate a lot of heat.

The good part is that Supermicro management expects "that the short-term margin pressure will ease and return to normal ranges before the end of fiscal year 2025, especially when our DLC [liquid cooling] and DCBBS [Datacenter Building Block Solutions] start to ship in high volume."

This explains why Supermicro is expecting another year of solid growth in revenue in fiscal 2025. The company expects full-year revenue to range between $26 billion and $30 billion, which means that it could double its top line if it manages to hit the higher end of its forecast. Also, the midpoint of the company's fiscal Q1 non-GAAP earnings guidance of $7.48 per share means that its bottom line is set to more than double from the year-ago period's figure of $3.43 per share, despite the margin pressure.

We have seen that management is expecting margins to start improving as the fiscal year progresses, so there is a good chance it could end the year with a sharp jump in its bottom line as well. That's why savvy investors would do well to capitalize on this AI stock's pullback, as it is now trading at just 14 times forward earnings and 2 times sales, despite delivering outstanding growth in both revenue and earnings.

Both multiples are lower than the U.S. technology sector's average sales multiple of 7.3 and earnings multiple of 42, making Supermicro stock a no-brainer buy right now, given how fast it is set to grow in the new fiscal year.

Before you buy stock in Super Micro Computer, consider this: