Companies worth more than $1 trillion are a rare breed, at least for now. Many more corporations will join this elusive group in the coming years and decades. And the next one to accomplish this feat might be Eli Lilly (NYSE: LLY) .

The pharmaceutical giant is one of the closest to a $1 trillion market cap among those companies closing in on that milestone. Here is why the drugmaker could beat out its competitors and continue growing long after.

Will valuation be an issue?

Eli Lilly's market cap is $885 billion as of this writing. It might not seem like a contest at these levels; the stock could easily crack the $1 trillion mark within a year. But other corporations are also close by. At least one of them, Berkshire Hathaway , is closer, with a market cap of $930 billion.

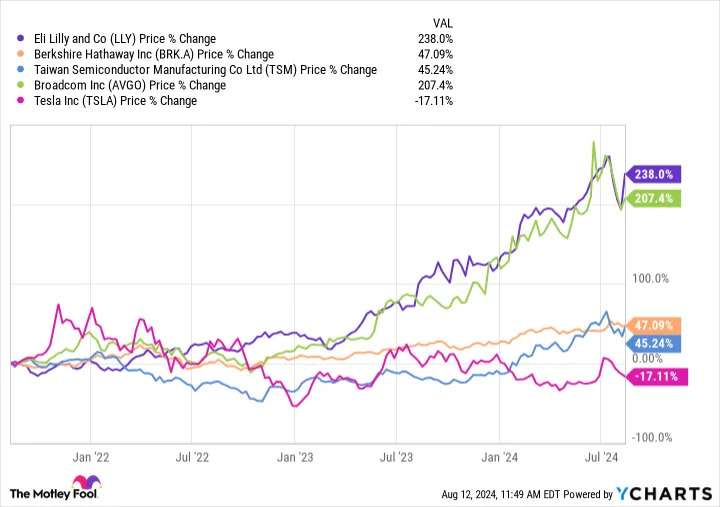

However, the single greatest reason Lilly could still make it to the trillion-dollar club ahead of Berkshire Hathaway and all of its similarly sized peers is its incredible pace of growth that has been a hallmark in recent years. The company has grown faster than the next likely cohort of trillion-dollar companies, a group that also includes Taiwan Semiconductor , Broadcom , and Tesla . (Tesla was briefly worth $1 trillion in late 2021 but hasn't performed well since.)

LLY data by YCharts .

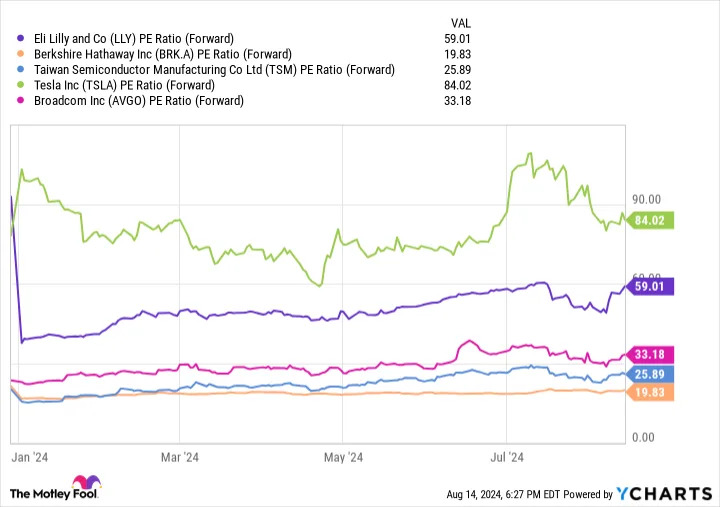

Still, what's the primary roadblock to a trillion-dollar valuation? Exactly that: valuation. Its forward price-to-earnings ratio (P/E) is 59.01 -- that's high by almost any metric. The healthcare industry's average is 19.1. In other words, any perceived issue with the business could lead to a significant stock price correction.

Meanwhile, Berkshire Hathaway's forward P/E is a much more reasonable 19.8. But it's important to note that many of the stocks in this cohort don't look particularly cheap.

LLY PE ratio (forward); data by YCharts .

Again, it's important to note that Lilly's past performance doesn't guarantee it will continue growing faster than all the other corporations within an arm's length of the trillion-dollar mark. That said, the company's financial results continue to impress.

In the second quarter, revenue increased by 36% year over year to $11.3 billion. Adjusted earnings per share (EPS) were up 86% year over year to $3.92. And Lilly increased its guidance for the full fiscal year, the second time this year it has done so.

Even management, which has more knowledge of the subject matter than anyone else, is underestimating the company's revenue and earnings potential. Shares soared by more than 8% after it released its second-quarter earnings report.

And there is even more to the story. Last year, Lilly sold the rights to Basqimi, a medicine that treats hypoglycemia. Excluding the $579 million in revenue that the sale of the rights to Basqimi contributed in the second quarter of 2023, the top line would have grown by 46%. The drugmaker also recently earned approval for Kisunla, a therapy for early symptomatic Alzheimer's disease.

It should be yet another significant growth driver for the drugmaker, considering there is a dire need in this area. Here's the bottom line: Lilly's shares have performed as well as they have in recent years because of the company's impressive clinical and regulatory progress. It is now reaping the benefits of that with scorching-hot financial results, and it should keep that up for the foreseeable future.

Right now Street analysts expect EPS to increase an average of 76% annually through the next five years. With projections like these, the company's valuation makes far more sense.

Eli Lilly could perform much better than Berkshire Hathaway, and at least as well -- or, at any rate, not significantly worse than other stocks within striking range -- to land at $1 trillion first.

Beyond the $1 trillion mark

What happens if and when Lilly becomes a $1 trillion company? The drugmaker should continue growing long after. It still has several important medicines in its pipeline that look incredibly promising.

Developing innovative therapies -- one of the most important aspects of a successful pharmaceutical business -- is right up the company's alley. Its pipeline currently features such products as orforglipron and retatrutide, two potential anti-obesity medicines. Weight loss treatments have recently played an essential role for Eli Lilly.

Even with mounting competition in this field, it should remain one of the leaders. Orforglipron and retatrutide could generate $8.3 billion and $5 billion in revenue by 2030, respectively, according to the research company Evaluate Pharma. Both are in phase 3 studies.

Lilly's early-stage programs include a potential gene therapy for hearing loss that has already cured one patient in a phase 1/2 trial. The company has plenty of other exciting programs beyond these.

So, although reaching a $1 trillion market cap would be a major milestone for Eli Lilly, investors shouldn't focus too much on that goal. The company is incredibly innovative and should continue delivering market-beating performance long after it gets there. To me, the stock is a table-pounding buy.

Before you buy stock in Eli Lilly, consider this: