Bitwise Asset Management , a cryptocurrency ETF provider, has acquired London-based digital asset issue ETC Group. The deal, announced today, will increase Bitwise’s assets under management to $4.5 billion, according to a company press release .

ETC Group, known for its physically backed bitcoin fund, brings approximately $1.1 billion in AUM to the transaction.

This acquisition comes as the ETF industry experiences a period of consolidation, with several major providers expanding their reach and diversifying their offerings.

Bitwise Adds to Crypto ETF Portfolio

San Francisco-based Bitwise, which launched a spot Bitcoin ETF in the United States earlier this year, currently manages seven ETFs with a total AUM of $2.7 billion.

Bitwise CEO Hunter Horsley said that the acquisition would allow the company to expand its offerings to better serve European investors.

“This acquisition allows us to serve European investors, to offer clients global insight, and to expand the product suite,” Horsley said, adding that the move aligns with Bitwise’s strategy to broaden its global reach and offer a diverse range of crypto investment products.

The ETC acquisition gives Bitwise access to a market where crypto-exchange traded products have been available for some time. This contrasts with the U.S. market, where spot Bitcoin ETFs only gained regulatory approval in early 2024.

The transaction follows other recent deals in the ETF industry, including Valkyrie Investments selling its ETF business to CoinShares , and Ark Investment Management acquiring Rize ETF Limited .

While specific terms of the deal were not disclosed, the acquisition brings ETC Group’s suite of crypto-focused exchange-traded-products under the Bitwise umbrella. These ETPs, which cover various digital assets beyond bitcoin, are expected to be rebranded with Bitwise’s name in the coming months.

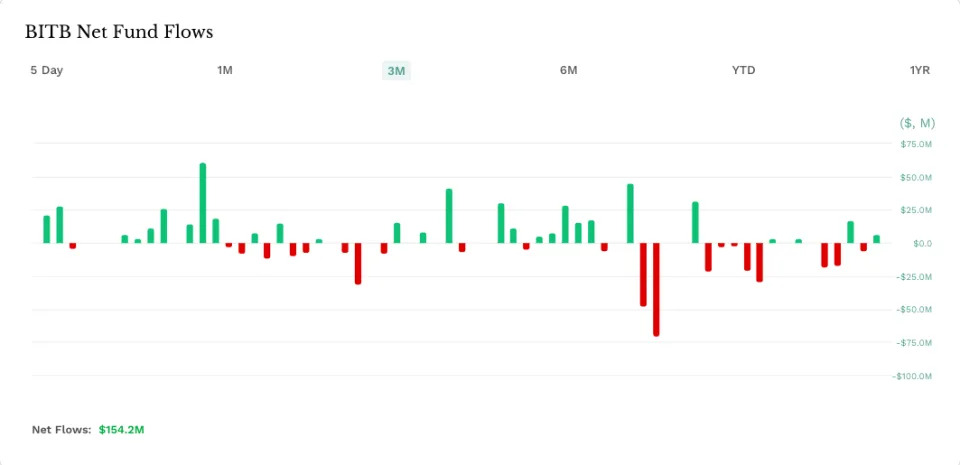

The Bitwise Bitcoin ETF (BITB) has generated about $2 billion in inflows since it started trading on Jan. 11, the fourth most among the 11 products that have received approvals from the Securities and Exchange Commission (SEC) this year, according to data from U.K. asset manager, Farside Investors.

Permalink | © Copyright 2024 etf.com. All rights reserved