The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how online marketplace stocks fared in Q4, starting with LegalZoom (NASDAQ:LZ).

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

The 13 online marketplace stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 2.1% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 17.6% since the latest earnings results.

LegalZoom (NASDAQ:LZ)

Founded by famous lawyer Robert Shapiro, LegalZoom (NASDAQ:LZ) offers online legal services and documentation assistance for individuals and businesses.

LegalZoom reported revenues of $161.7 million, up 1.9% year on year. This print exceeded analysts’ expectations by 0.6%. Overall, it was a strong quarter for the company with EBITDA guidance for next quarter exceeding analysts’ expectations and a decent beat of analysts’ number of subscription units estimates.

“We are making solid progress against our goal to position LegalZoom for long-term, sustainable growth,” said Jeff Stibel, Chairman and Chief Executive Officer of LegalZoom.

The stock is down 20.7% since reporting and currently trades at $7.03.

Is now the time to buy LegalZoom? Access our full analysis of the earnings results here, it’s free .

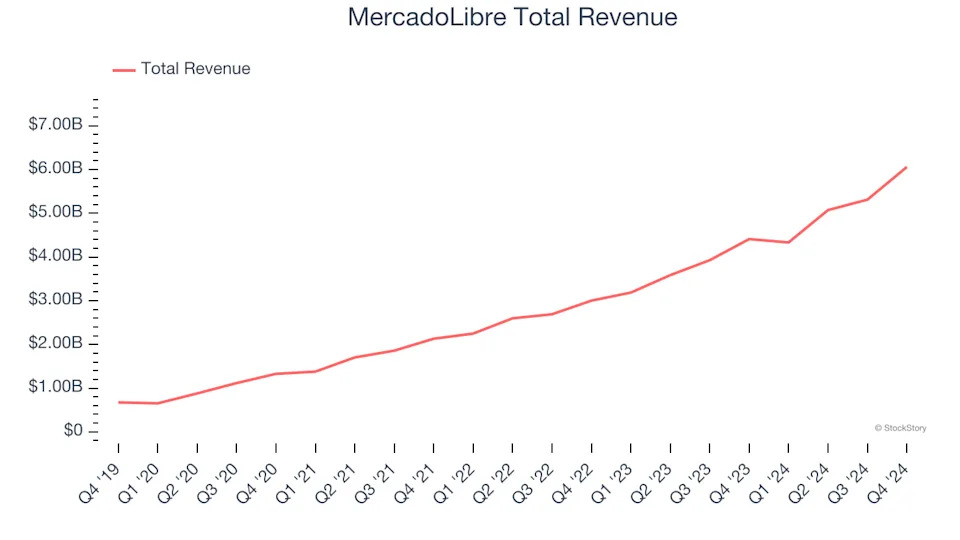

Best Q4: MercadoLibre (NASDAQ:MELI)

Originally started as an online auction platform, MercadoLibre (NASDAQ:MELI) is a one-stop e-commerce marketplace and fintech platform in Latin America.

MercadoLibre reported revenues of $6.06 billion, up 37.4% year on year, outperforming analysts’ expectations by 2.8%. The business had an exceptional quarter with a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ number of unique active users estimates.

The market seems content with the results as the stock is up 4.2% since reporting. It currently trades at $2,208.

Is now the time to buy MercadoLibre? Access our full analysis of the earnings results here, it’s free .

Weakest Q4: Teladoc (NYSE:TDOC)

Founded to help people in rural areas get online medical consultations, Teladoc Health (NYSE:TDOC) is a telemedicine platform that facilitates remote doctor’s visits.

Teladoc reported revenues of $640.5 million, down 3% year on year, in line with analysts’ expectations. It was a softer quarter as it posted full-year EBITDA guidance missing analysts’ expectations significantly and a significant miss of analysts’ EBITDA estimates.

Teladoc delivered the slowest revenue growth in the group. The company reported 93.8 million users, up 4.7% year on year. As expected, the stock is down 33.5% since the results and currently trades at $7.31.

Read our full analysis of Teladoc’s results here.

Shutterstock (NYSE:SSTK)

Originally featuring a library that included many of founder Jon Oringer’s photos, Shutterstock (NYSE:SSTK) is now a digital platform where customers can license and use hundreds of millions of pieces of content.

Shutterstock reported revenues of $250.3 million, up 15.2% year on year. This result missed analysts’ expectations by 1.5%. It was a softer quarter as it also produced a decline in its requests and a miss of analysts’ EBITDA estimates.

The company reported 33 million service requests, down 6.8% year on year. The stock is down 31.1% since reporting and currently trades at $16.83.

Read our full, actionable report on Shutterstock here, it’s free.

EverQuote (NASDAQ:EVER)

Aiming to simplify a once complicated process, EverQuote (NASDAQ:EVER) is an online insurance marketplace where consumers can compare and purchase various types of insurance from different providers

EverQuote reported revenues of $147.5 million, up 165% year on year. This print surpassed analysts’ expectations by 10%. It was an exceptional quarter as it also recorded EBITDA guidance for next quarter exceeding analysts’ expectations.

EverQuote delivered the fastest revenue growth among its peers. The stock is up 15% since reporting and currently trades at $23.18.

Read our full, actionable report on EverQuote here, it’s free.

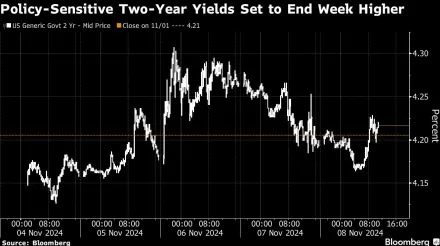

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here .