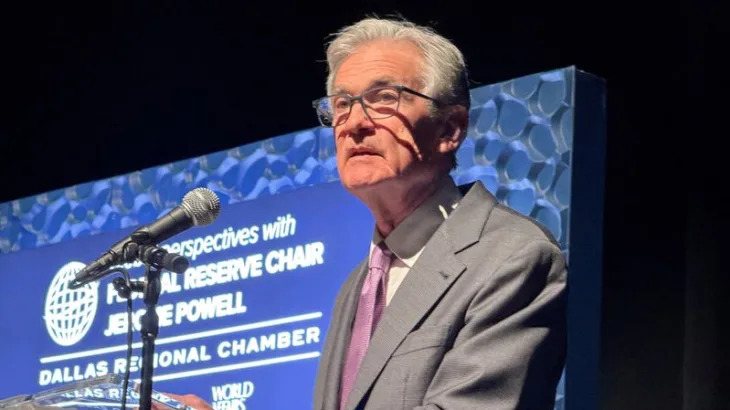

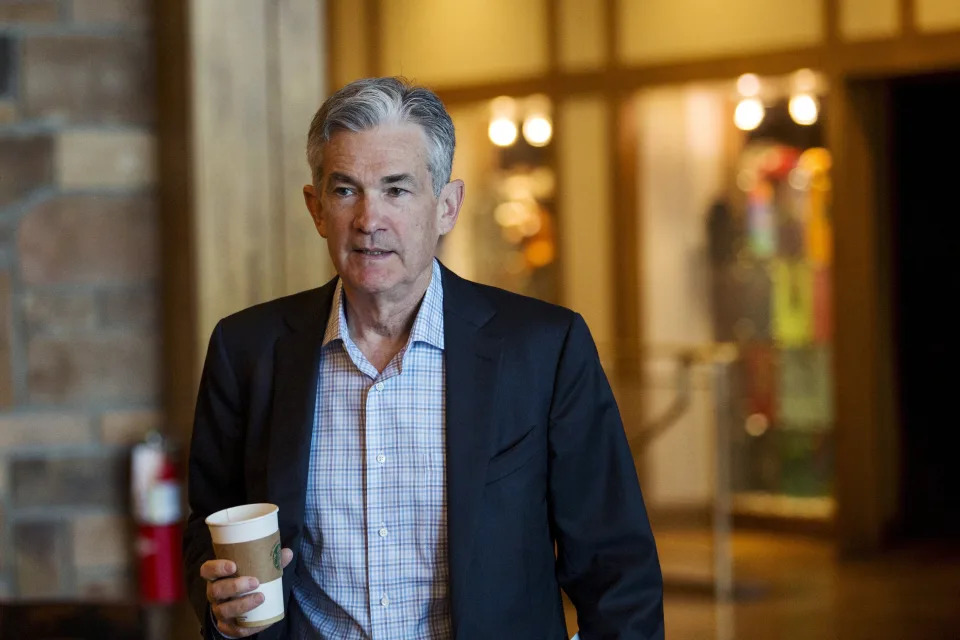

Initial filings for unemployment benefits were roughly flat last week, reflecting a labor market that is cooling but not rapidly deteriorating as the employment outlook remains in focus ahead of Federal Reserve Chair Jerome Powell's Friday speech in Jackson Hole, Wyo.

New data from the Department of Labor released Thursday showed 232,000 initial jobless claims filed in the week ending Aug. 17, up from 228,000 the week prior and in line with economists' expectations.

Continuing jobless claims rose again to 1.86 million, the highest level since November 2021.

"Claims appear to be leveling off on a trend basis," Oxford Economics senior economist Nancy Vanden Houten wrote in a note to clients on Thursday. "There is nothing in the claims data to change our view that, while the labor market is softening, it isn't weak enough to warrant anything more than a 25bps rate cut at the Fed's September meeting."

Oliver Allen, senior economist at Pantheon Macroeconomics, added in a client note on Thursday: "Underlying claims have plateaued, and will probably slip back in the near term."

With recent data showing inflation falling , economists have argued the labor market will be "where the action is going to be" as investors search for clues about how much the Federal Reserve will slash interest rates this fall.

How does the labor market affect inflation?

Fresh minutes from the Federal Reserve's July meeting released on Wednesday noted that Fed officials believe "upside risks to the inflation outlook were seen as having diminished, while downside risks to employment were seen as having increased."

This commentary from the meeting came before several data points over the past few weeks that have shown a cooling in the labor market. Just days after the Fed's most recent meeting, the July jobs report showed the second-weakest monthly job additions since 2020 and the highest unemployment rate, 4.3%, in nearly three years.

On Wednesday, an annual benchmark revision from the BLS showed the US economy employed 818,000 fewer people than originally reported as of March 2024, revealing the labor market may have slowed earlier and by a greater magnitude than initially thought.

Deutsche Bank senior US economist Brett Ryan said the revisions data is in line with the recent increases in the unemployment rate.

"[The revisions data] solidifies the case for starting cuts in September," Ryan said. "It doesn't necessarily advance the case for aggressive cuts off the bat, which the market has been ... looking to get signals for."

That signal could come from Powell on Friday when he delivers his annual speech at the Jackson Hole Symposium. But Ryan reasons the case for a 50 basis point interest rate cut is more likely to be settled when the August jobs report is released on Sept. 6.

"The committee wants to be very much data dependent and doesn't feel that it wants to outline a preset course here," Ryan argued. "So there isn't much he could say."

As of Thursday afternoon, markets were fully pricing in an interest rate cut from the Fed by the end of September, with a roughly 25% chance the Fed cuts interest rates by 50 basis points, per the CME FedWatch Tool.

Josh Schafer is a reporter for Yahoo Finance. Follow him on X @_joshschafer .