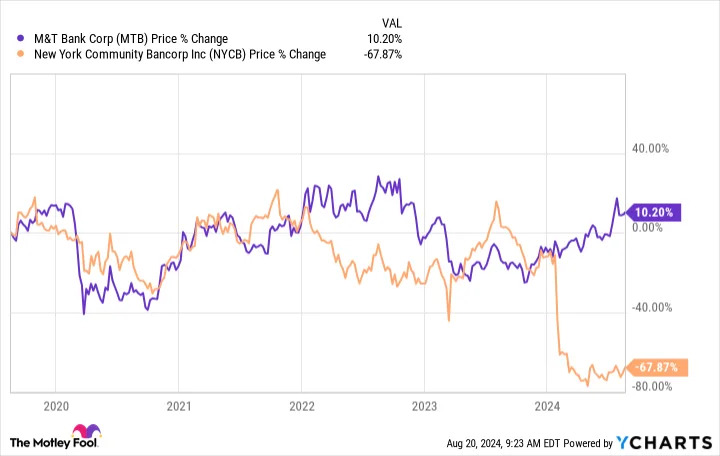

New York Community Bancorp (NYSE: NYCB) is a turnaround stock that only the most aggressive investors will want to own. On the other hand, more conservative investors will probably find M&T Bank (NYSE: MTB) a far more appealing option, noting that an aggregate of 13F filings shows that it is a favorite among the world's largest investors. Here's why you might want to avoid New York Community Bancorp and, instead, buy M&T Bank, like the so-called "smart money" is doing.

New York Community Bancorp crumbled

When interest rates rose, banks could initially charge higher rates for loans and earn more money. But then there was increasing competition for customer cash, which forced banks to raise the interest they offered on banking products (like bank accounts, CDs , and checking accounts). In other words, the basic operation of banks got harder. On top of that, higher rates increased the risk of default among borrowers.

That's the backdrop under which New York Community Bancorp's business began to falter. The biggest push toward trouble, however, probably came from the bank's purchase of two bank peers in just a few years. The increase in scale meant increased scrutiny from regulators, which New York Community Bancorp just wasn't ready for. Additionally, some loans soured unexpectedly while competition rose.

The bank ended up cutting its dividend to a mere token and took a $1 billion bailout from outside investors.

Right now, New York Community Bancorp is a high-risk turnaround play. Given the bailout and the complete overhaul of management, the bank will probably survive. But business won't be back to normal until the end of 2026, at the earliest, according to management. Unless you have a strong stomach, you'll be better off buying another bank.

Big investors are buying M&T Bank

M&T Bank is the bank among the top 10 stocks getting the most attention from large investors, according to a cumulative review of 13F filings by WhaleWisdom.com. M&T Bank is a regional bank serving the U.S. Northeast, with a network of over 1,000 branches that spans 12 states from Maine to Virginia. In 2022, it bought People's United Bank. The key here is that M&T Bank shares some notable business similarities with New York Community Bancorp, but it didn't fall into financial trouble.

MTB data by YCharts .

To be fair, M&T Bank isn't exactly hitting on all cylinders right now. Second-quarter 2024 earnings results were acceptable, but they were down year over year in key areas. For example, revenues declined 11.5%. Earnings per share fell from $5.05 in Q2 2023 to $3.73 in 2024.

Return on common equity dropped to 9.9% from 14.2%, and charge-offs for bad loans increased from 0.38% to 0.41%. None of that is great, but M&T Bank is muddling through a rough spot reasonably well -- and certainly better than New York Community Bancorp managed to.

That said, M&T Bank's stock is around 15% below the highs it reached in 2023. The stock has been rallying, likely as a result of the increased popularity among large investors, but there's still some recovery potential here. After that, the bank's recent acquisition-led expansion and the potential for improvement in its financial results amid more favorable market conditions suggest there could be more room for appreciation.

While you wait for better times, meanwhile, you can collect the stock's 3.2% dividend yield. While not huge, it's more than the 1.2% you'd get from the S&P 500 index and the 2.7% average for regional banks, using the SPDR S&P Regional Banking ETF (NYSEMKT: KRE) as a proxy.

M&T Bank isn't perfect, but the "smart money" seems to like it

Given the recent financial results, it is hard to suggest that M&T Bank is thriving right now. But it isn't falling off a cliff, either, as did New York Community Bancorp. If you have been looking at troubled New York Community Bancorp, you might want to take the time to see why big investors are buying M&T Bank instead. You might find that you want to follow the billionaires instead of hoping that New York Community Bancorp can successfully turn around its business.

Before you buy stock in M & T Bank, consider this: