Regardless of who wins the Presidential election in November, it's going to be a win for the stock market according to Ned Davis Research.

The research firm said in a note on Wednesday that the economic proposals of both Democrat nominee Kamala Harris and Republican nominee Donald Trump, would both stimulate the economy.

"Based on the annual average of these limited assessments, both Harris and Trump will run up the budget deficit to the tune of $220 billion to $650 billion per year, which will stimulate economic growth," NDR's senior US economist Veneta Dimitrova said.

That, combined with expected interest rate cuts from the Federal Reserve, should result in a risk-on environment for the stock market in 2025.

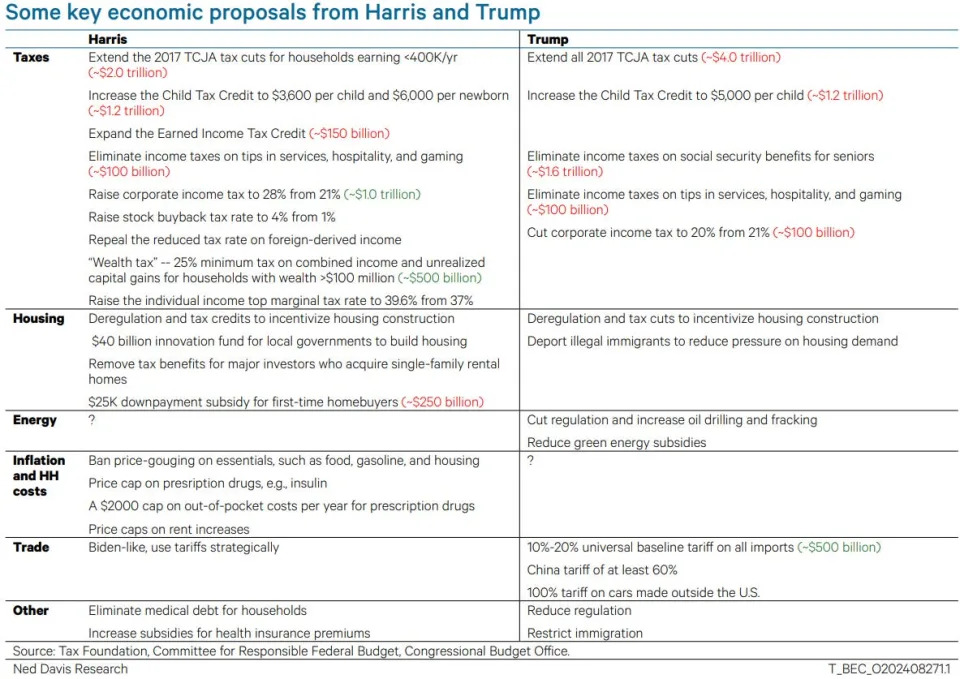

Some of the major stimulative proposals from the Harris camp include extending the 2017 TCJA tax cuts for households earning less than $400,000 per year, increasing the Child Tax Credit to $3,600 per child and $6,000 per newborn, and eliminating income taxes on tips.

For Trump, the stimulative economic proposals include extending the 2017 TCJA tax cuts for all, increasing the Child Tax Credit to $5,000 per child, and eliminating income taxes on social security benefits for seniors.

Trump is also advocating for an elimination of income taxes on tips.

Below is a list of economic proposals from both candidates, and their estimated impact on the federal deficit.

Potential stimulus measures from Trump or Harris will be in addition to the hundreds of billions of dollars of stimulus that are set to hit the economy thanks to laws already enacted during the Biden administration.

"Such stimulus will combine with other government spending already in the pipeline from signature Biden laws, including the Infrastructure Investment and Jobs Act, the Inflation Reduction Act, and the CHIPS Act, that are set to deliver an estimated $357 billion of direct government spending through 2031," Dimitrova said.

She added: "Regardless of who wins the election, this implies a tailwind to economic growth and equity markets in 2025."

A falling US dollar is also in the cards next year according to the note, especially if the US deficit grows even more, and a weaker greenback tends to be a tailwind for corporate profits and US stock prices.

While the trillions of dollars of potential stimulus could be great for the economy and stock market, it could also spark another surge in inflation.

That's especially true if Trump's across-the-board tariff proposals or Harris' price gouging measures are enacted, Dimitrova said.

But it's worth noting that these are all proposals, and whether they become law hinges on which party wins Congress.

"Ultimately, the makeup of Congress, which may also change in this election, will determine the feasibility of these proposals and may act as a check on spending and tax changes," Dimitrova said.

Read the original article on Business Insider