US stocks continued to fall on Wednesday as traders took in more weak jobs data, fueling fears over the strength of the US economy. All three benchmark indexes ticked lower, while bond yields slumped.

The economy had fewer job openings than expected in July, with employers posting 7.67 million open positions at the end of the month, per the Bureau of Labor Statistics . That's lower than the 7.91 openings recorded in June, and it's the lowest number of available jobs in over three years.

The new job openings data adds to the fears of a slowing economy raised by Tuesday's manufacturing figures. Yields dropped on Wednesday, extending declines in key government bond yields logged in the prior session. The 10-year Treasury yield fell eight basis points to 3.761%.

"Adding further evidence of a decelerating US labor market, for-hire signs sunk to their most anemic level in 42 months," José Torres, a senior economist at Interactive Brokers, said in a note. "The figure, the lightest since January 2021, is generating optimism that the Fed will provide liquidity relief, but such exuberance is being countered by pessimism concerning economic growth."

"As Chairman Jerome Powell said recently, further cooling of the job market is unwelcome. But that is exactly what the JOLTS update conveys," Mark Hamrick, a senior economic analyst at Bankrate, said in a note.

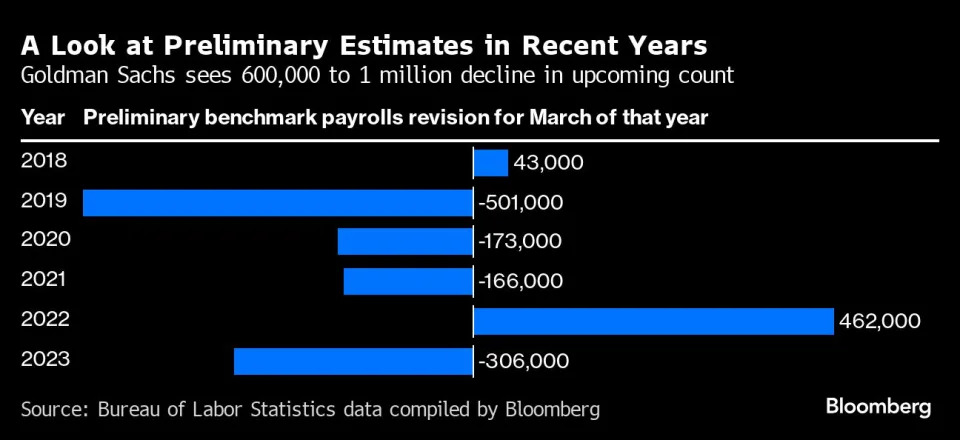

Fears of a recession could be further solidified by a weak jobs report on Friday. Economists expect the US to have added 162,000 jobs last month, which would lower the unemployment rate to 4.2%.

Investors, meanwhile, ramped up their expectations for aggressive rate cuts by year-end. Markets are pricing in an 86% chance the Fed will cut rates by 100 basis points or more by the end of the year, up from just 72% odds on Tuesday, according to the CME FedWatch tool .

Here's where US indexes stood at the 4:00 p.m. closing bell on Wednesday:

Here's what else is going on:

In commodities, bonds, and crypto:

Read the original article on Business Insider