Chip giant AMD ( AMD ) reported its second quarter earnings after the bell on Tuesday, beating analysts' expectations on the top and bottom lines and posting better-than-anticipated guidance for the third quarter.

AMD, like rival Nvidia, is riding the AI hype train, which is powering sales of its data center graphics processing units (GPUs) and central processing units (CPUs). For the quarter, AMD reported adjusted earnings per share (EPS) of $0.69 and revenue of $5.8 billion. Wall Street was anticipating adjusted EPS of $0.68 on revenue of $5.7 billion, according to consensus estimates by Bloomberg. AMD reported adjusted EPS of $0.58 on revenue of $5.4 billion during the period in 2023.

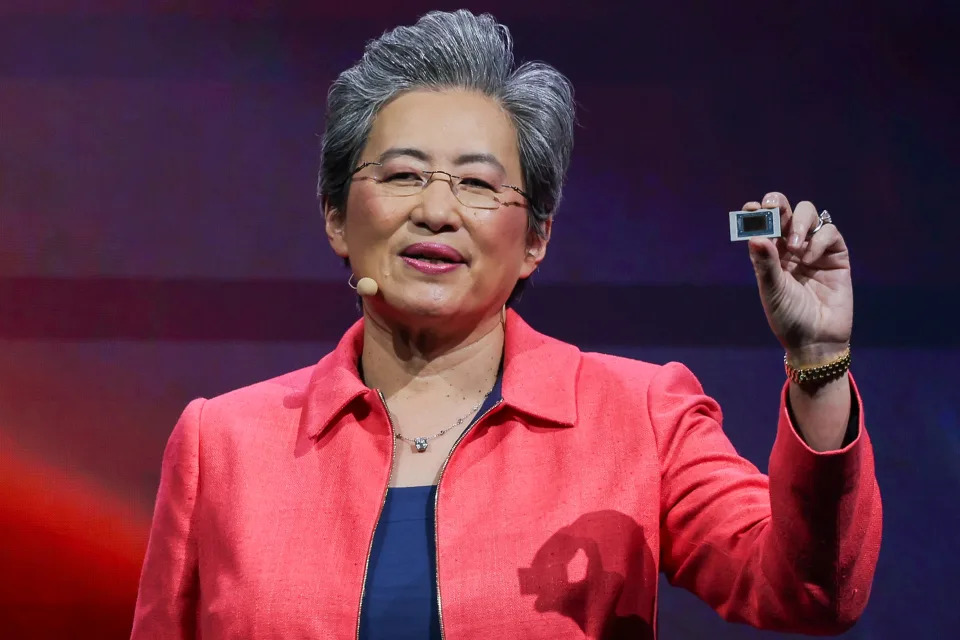

"Our AI business continued accelerating and we are well positioned to deliver strong revenue growth in the second half of the year led by demand for Instinct, EPYC and Ryzen processors," AMD CEO Lisa Su said in a statement.

"The rapid advances in generative AI are driving demand for more compute in every market, creating significant growth opportunities as we deliver leadership AI solutions across our business.”

AMD's Data Center revenue, which includes sales of AMD's GPUs and CPUs, topped out at $2.8 billion, beating expectations of $2.75 billion. That's a 115% jump versus the same quarter last year, when AMD reported Data Center revenue of $1.3 billion.

Shares of AMD rose as much as 5% following the report, while shares of rival Nvidia ( NVDA ) jumped 3%. Shares of Intel ( INTC ) were flat.

AMD's current top GPU is its MI300X. During a press conference at the Computex event in Taiwan in June, AMD said partners and customers, including Microsoft, Meta, Dell, HPE, and Lenovo, are already adopting the chip. The company also revealed that its next-generation MI325X will be available beginning in Q4, while the MI350X will hit the market in 2025. AMD said it will roll out the MI400 in 2026.

It's not just AI that matters for AMD, though. Its Client segment, which includes sales of chips for PCs, is still an important part of its business. For the quarter, the company reported revenue of $1.5 billion beating expectations of $1.45 billion, and up from $998 million in the same period last year.

The Client segment beat comes as the PC industry continues its turnaround following a significant slowdown after the explosive growth seen at the onset of the pandemic.

But that was four years ago, and consumers are beginning to shop for replacements for the PCs they bought at the start of the pandemic. That, according to IDC, has resulted in worldwide PC shipments increasing 3% year over year in the second quarter, marking the second quarter of growth after eight consecutive quarters of declines.

Gaming revenue topped out at $648 million in Q2, down 59% year-over-year from $1.5 billion, but beating estimates of $646 million.

Like the PC industry, the gaming industry has also been contending with a slowdown compared to the high-flying sale days of the early pandemic era. Still, there's hope for the gaming industry going into the end of 2024 and start of 2025 as Nintendo prepares to launch its next console and Take-Two readies its highly anticipated "Grand Theft Auto VI" later next year.

AMD is the first of the big three chip companies to report its earnings this quarter. Intel will follow suit on Aug. 1, while Nvidia will report its earnings on Aug. 28.

Correction: A previous version of this story misstated gaming earnings as billions rather than millions. It has been corrected.

@DanielHowley .

For the latest earnings reports and analysis, earnings whispers and expectations, and company earnings news, click here