Some Fed watchers are urging the central bank to do something it rarely does: lower rates outside of a regularly scheduled policy meeting.

The Fed has done so before, but typically during times of extreme crisis. The 2020 global pandemic. The 2008 financial meltdown. The 1987 "Black Monday" market crash.

The calls for the Fed to do so before its next meeting on Sept. 17-18 got louder Monday during the worst one-day rout for the stock market since 2022.

There is a "strong case to act before September," JPMorgan chief economist Michael Feroli said in a research note.

The central bank chose last week to keep its rates at a 23-year high while hinting that a first cut could happen at a regularly scheduled Sept. 17-18 meeting if data backed up such a move.

The Fed looks to be "materially behind the curve," added JPMorgan’s Feroli, who expects a 50-basis-point cut at the September meeting followed by another 50-basis-point cut in November.

Other Fed observers urged calm, noting that an emergency move from the Fed before the September meeting could, in fact, create even more panic in markets that restored some calm on Tuesday.

"It's incredible to hear people calling for an inter-meeting cut," Allianz chief economic adviser Mohamed El-Erian told Yahoo Finance Monday. "It's not going to happen."

The last time the Fed lowered rates between meetings was in March 2020, when the COVID-19 pandemic hit and shut down the economy. It sparked one of the sharpest — and shortest — recessions on record.

Before the pandemic, there were emergency cuts triggered by the financial crisis in 2008 and in 2001 following the bursting of a tech bubble and the shock of the Sept. 11 terrorist attacks.

Earlier emergency cuts followed the stock market crash in October 1987, a recession in the early 1990s, and the collapse of hedge fund Long-Term Capital Management in 1998.

There is no doubt that the pressure on the Fed to slash rates is now rising following a weak jobs report last Friday that stoked fears of a recession. Data from the Bureau of Labor Statistics released last Friday showed the unemployment rate at its highest level since October 2021.

Wall Street is now pricing in rate cuts of half a percent in both September and November and another quarter-point cut in December. Previously traders were looking at two quarter-point cuts for the rest of this year.

But Wilmer Stith, bond portfolio manager for Wilmington Trust, said this doesn’t mean the Fed will decide to do something before its September meeting.

"If things continue to fall out of bed at the rate that they seem to be falling, anything is possible," he said, "but I think it’s unlikely that they move inter-meeting because I think that's just going to put more fear into the market."

Hedge fund manager James Fishback is in that same camp, arguing in a note that the Fed won’t overreact based on one slow jobs report.

Another reason Fishback believes the Fed won’t act between meetings: politics.

An emergency cut would suggest a real crisis that could hurt Vice President Kamala Harris’s electoral chances and open an attack line for former President Donald Trump. Fishback maintains the Fed is largely composed of Democrats.

"The Fed’s undeniable political lean makes an emergency rate cut and/or aggressive rate cuts less likely," he said.

"I doubt politics would be a major factor in determining the size of a September rate cut, but in a close call, politics could certainly play a role."

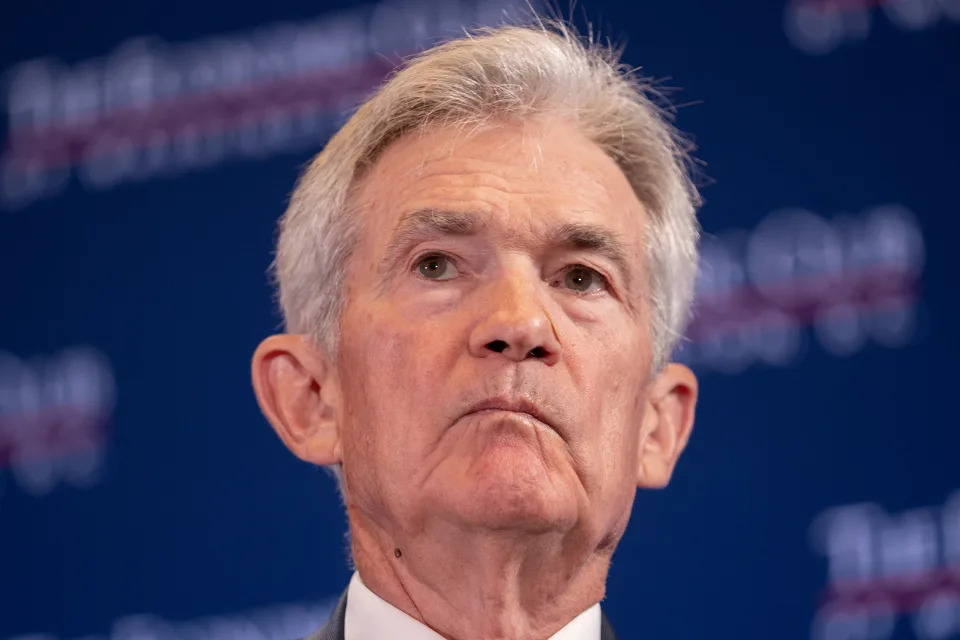

Powell has argued that the central bank will remain nonpolitical as the Fed considers whether to lower rates in coming meetings, emphasizing that the only criteria that he considers will be data on prices and jobs.

Last week he was dismissive of the idea of a 50-basis-point cut when asked about it at a press conference, making it sound like a 25-basis-point cut was more likely for September if the Fed decides to act.

"I don't want to be really specific about what we're going to do, but that's not something we're thinking about right now," Powell said at the press conference. "Of course, we haven't made any decisions at all as of today."

Powell will have another chance to give his thoughts on the path of monetary policy when he gives a speech in roughly two weeks at the Fed’s annual confab in Jackson Hole, Wyo.