You'd think that this would be a great time to be a Walt Disney (NYSE: DIS) shareholder. After a tough calendar 2023 at the box office, Disney has broken records with two of its summertime theatrical releases. Last month it announced major additions coming to its theme parks worldwide in the next five years. The media giant has posted double-digit percentage bottom-line beats over the past year. It also emerged victorious in a springtime proxy war against a pair of activist groups.

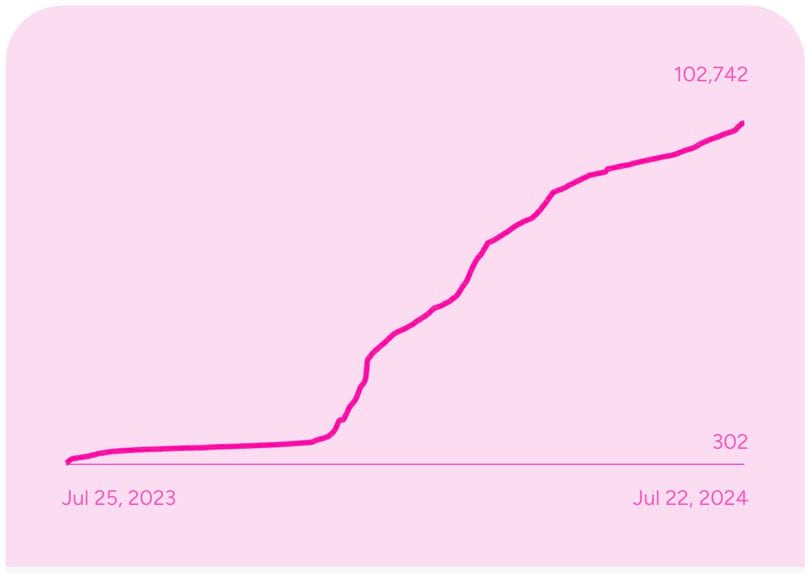

Despite all of the positive developments, Disney is trading lower for the sixth consecutive month. The stock has now fallen 28% since the end of March, a rough comparison to the generally buoyant market in that time.

There are naturally a few things that haven't gone right for the House of Mouse. There are a lot of moving parts to Disney, and things don't always go as scripted even for a seasoned Hollywood storyteller without equal. Let's go over the challenges facing Disney that could be keeping the stock in check. Then I'll get into why it's probably a smart buying opportunity anyway.

Under the seethe

It's not all pixie dust for Disney. The media mogul is currently in a lose-lose battle, with its media networks currently not available on DirecTV. Its plan to team up with two other sports programming giants, Fox Corp. and Warner Bros. Discovery , for the mother of all bundles has run into legal resistance. Theme park trends have also softened at its largest resort.

There are a lot more things going right than wrong at Disney, but stock charts don't lie. Investors have lost interest in Disney as a portfolio cornerstone since its shareholder meeting in early April. The boardroom won the proxy battle that day, but did it lose the war?

In the mad scramble to curry favor with its shareholders, Disney emptied its bag of near-term bullish announcements. That left it somewhat empty-handed when it would announce its fiscal second-quarter results in May, but that doesn't mean it's been ho-hum on the catalyst front. Reality has been kinder than promised. Its streaming business turned a profit two fiscal quarters earlier than expected. No one was expecting Inside Out 2 to be the world's highest-grossing movie since 2022's Avatar: The Way of Water .

A whole new whirl

Disney shares are the cheapest that they have been on this end of the pandemic. It's trading for less than 18 times what it's expected to earn in the fiscal year that ends this month. You will find lower valuations out there, but it's been a long time since you can pick up the media stock bellwether for an earnings multiple in the teens.

Disney won't post fresh financials until November, but it's not the only potential bullish catalyst in the near-term horizon. If you think Inside Out 2 and Deadpool & Wolverine were box-office blockbusters this summer, this calendar year will end with two potentially bigger entries in the Moana and Lion King franchises. If you think it's a big deal that Disney+ is turning a profit, imagine what will happen when prices inch higher across the streaming services on Oct. 17.

It may not be fair to ask Disney to rebrand itself as Princess Aurora, but it's starting to look a lot like a Sleeping Beauty right now.

Should you invest $1,000 in Walt Disney right now?

Before you buy stock in Walt Disney, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Walt Disney wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $630,099 !*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 3, 2024

Rick Munarriz has positions in Walt Disney. The Motley Fool has positions in and recommends Walt Disney and Warner Bros. Discovery. The Motley Fool has a disclosure policy .

Can Disney Stock Avoid Falling for the Sixth Month in a Row? was originally published by The Motley Fool