(Bloomberg) -- Stocks struggled to gain traction after a $1.3 trillion rally, with the latest economic data failing to boost market momentum.

The S&P 500 fluctuated after a three-day advance. Treasuries saw mild losses across the US curve. Swap traders continued to project a quarter-point Federal Reserve rate cut next week, and 100 basis points in policy easing this year. The dollar fell against most of its major counterparts.

The producer price index for final demand increased 0.2% from a month earlier after a downward revision to July’s reading. The median forecast in a Bloomberg survey of economists called for a 0.1% gain. Separate data showed applications for US unemployment benefits ticked up, consistent with a gradual slowdown.

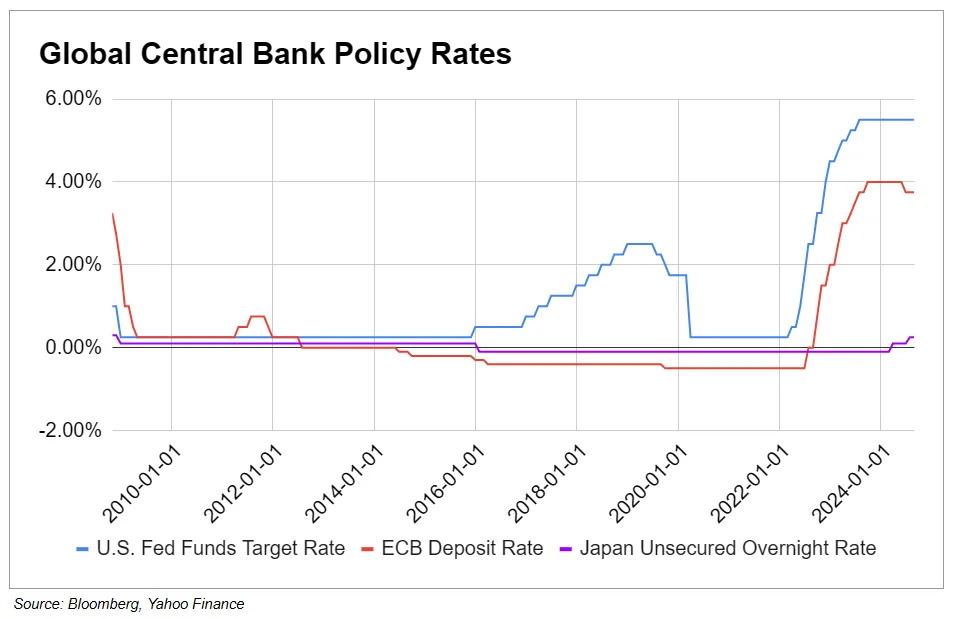

“The economy isn’t falling apart, so the Fed has time to get rates down,” said Brian Henderson at BOK Financial. “They’re probably going to start off fast with cuts of 25 basis points each in September, November and December, and then may slow to one rate cut per quarter in the new year.”

The S&P 500 was little changed. The Nasdaq 100 added 0.1%. The Dow Jones Industrial Average fell 0.2%. A gauge of the “Magnificent Seven” megacaps climbed 0.4%. The Russell 2000 of small firms advanced 0.8%. Kroger Co. rallied on a bullish outlook. Micron Technology Inc. sank on an analyst downgrade. Moderna Inc. plunged on a disappointing sales view.

Treasury 10-year yields advanced three basis points to 3.68%. That’s ahead of a $22 billion sale of 30-year bonds. German bunds snapped a seven-day winning streak after European Central Bank President Christine Lagarde said rates will be sufficiently restrictive in the wake of an expected quarter-point interest rate cut to 3.5%.

Oil surged after storm Francine disrupted crude production in the Gulf of Mexico. Gold hit an all-time high.

After Wednesday’s impressive tech-driven rally, there’s a question of whether we’ll see any real momentum carry over, according to Fawad Razaqzada at City Index and Forex.com.

“While there’s been some continuation to the upside, any hint of fading momentum could put the bulls back on shaky ground,” he said. “After all, clear bullish catalysts seem few and far between at the moment.”

To Dan Wantrobski at Janney Montgomery Scott, the wild swings that marked the previous session were indicative of the multi-directional volatility investors are likely to face moving through the September-October time frame.

“But while yesterday’s strong reversal improves the near-term technical picture, calls for a bottom and new bull market may be premature at this time,” he said. “Based on breadth/participation and volume patterns yesterday, we remain in defensive mode over the near term, and would note the markets have experienced similar extended periods of volatile trading (in both directions) in the past.”

Corporate Highlights:

Key events this week:

Some of the main moves in markets:

Stocks

Currencies

Cryptocurrencies

Bonds

Commodities

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Lu Wang.