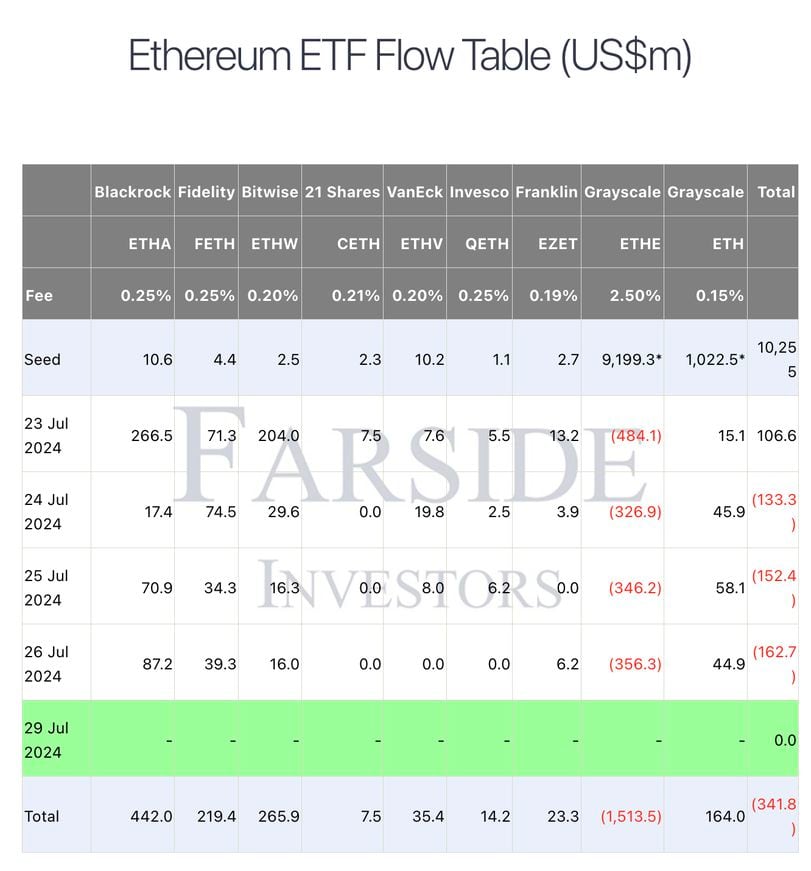

Spot ether (ETH) exchange-traded funds saw negative net flows in their first week as massive outflows from the incumbent Grayscale Ethereum Trust (ETHE) overwhelmed interest in the competing products.

Similar bitcoin (BTC) funds, which debuted in January, raked in $1 billion net inflows during the first four days, even as they too suffered sizable outflows from a previously existing Grayscale fund.

Overall the spot ETH ETFs endured $340 million in net outflows with more than $1.5 billion exiting from the Grayscale Trust, according to Farside Investors .

The price action seemed to reflect the lackluster ETF action, with ether slipping 5% last week while bitcoin added 2%.

Forgetting Grayscale's ETHE, the other newly listed ether ETF products did attract $1.15 billion inflows last week, led by offerings from BlackRock, Bitwise and Fidelity.

While the current pace of outflows from ETHE would mean the fund would run out of assets in the next four weeks, analysts expect that they could start tapering off as early as this week.

Quinn Thompson, founder of digital asset hedge fund Lekker Capital, pointed out that ETHE have already shed the same amount of assets as GBTC when bitcoin found a local bottom in late January during its post-ETF sell-off. BTC fell 15% to below $39,000 in two weeks, then marched on a rally to new all-time highs.

Mads Eberhardt, senior crypto analyst at Steno Research, noted that GBTC outflows significantly subsided after the eleventh trading session, and predicted that ETHE could follow the same path.

"The Ethereum ETF net outflow is yet to subside, but it is likely that it will happen this week," Eberhard said in a Monday X post. "When it does, it's up only from there," he said.