The supply of the two top stablecoins, Tether's (USDT) and Circle's (USDC) , grew nearly $3 billion in a week, a sign that investors rushed to buy cryptocurrencies at lower prices after Monday's tumble.

Tether transferred $1.3 billion of USDT to exchanges and market makers since Monday, onchain sleuth Lookonchain noted . With the latest issuance, USDT's market capitalization climbed over $115 billion to a new record high.

The market capitalization of second-largest stablecoin, USDC also grew some $1.6 billion this week to $34.5 billion, the highest since March 2023, TradingView data shows. David Shuttleworth, research partner at Anagram, noted that USDC on the Ethereum network recorded the bulk of the expansion with $1.36 billion, while USDC on Solana saw $356 million inflows.

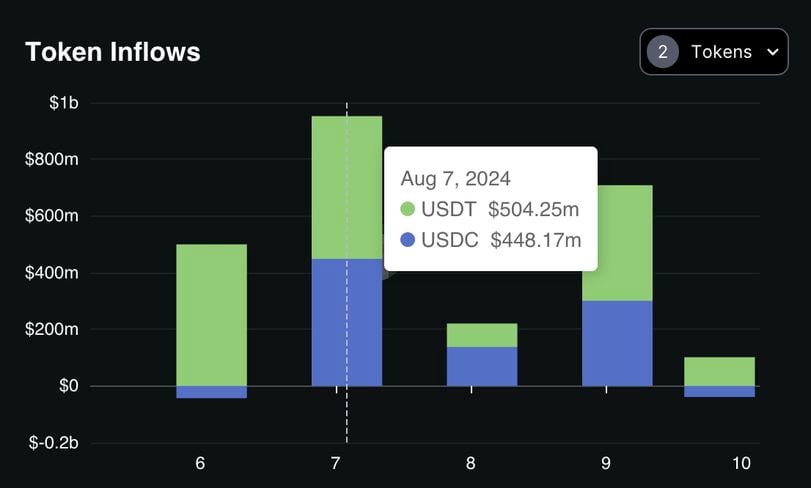

The growth happened as customers appeared to move funds to exchanges following the sell-off. Binance, the largest crypto exchange, saw over $1.5 billion in USDT deposits and $820 million in USDC deposits in four days following the Monday crash, DefiLlama data shows.

Digital asset broker FalconX also noted the buying pressure, saying that "pretty much all investor" types including hedge funds, venture funds and retail aggregators were "net buyers."

Stablecoins are tokenized versions of cash, bridging traditional (fiat) money and blockchain-based markets and providing market participants with liquidity for trading and lending. They serve a key role in the crypto space, and expanding stablecoin supply is usually a sign of health of the broader market.

The total stablecoin market cap grew rapidly between November and March, coinciding with the rally in cryptocurrency prices and bitcoin (BTC) hitting a new record-high above $72,000. However, it stalled for a few months as the crypto market cooled off. Last month, it started to show signs of renewed growth.

Read more: Stablecoins Signal Crypto Ecosystem Buoyancy as Market Cap Jumps to $164B \

Tether CEO Paolo Ardoino said in a Bloomberg interview that the company plans to double its staff to 200 by mid-2025, increasing its workforce in a number of areas including compliance.