-

BTC's long-term options market indicator continues to signal bullish bias.

-

Key indicator shows signs of bargain hunting during the price drop.

Bitcoin (BTC) has had a horrible August, falling over 13% to as low as $50,000 in the first five days due to several factors, including the unwinding of yen carry trades and concerns about the U.S. economy.

Still, market participants can find encouragement in at least two indicators, the first of which is connected to bitcoin options listed on the leading exchange Deribit.

Long-term options skew remains bullish

Despite the market swoon, bitcoin's 180-day call-put skew remains flat-lined above 3, indicating a bias for price strength over six months, data tracked by Amberdata show.

A call option gives the holder the right but not the obligation to buy the underlying asset at a specific price at a later date and represents a bullish bet on the market. A put represents a bearish bet. Options skew measures investors' willingness to pay for an asymmetric bullish or bearish payout. Positive values suggest relatively stronger demand for upside or calls.

The bullish long-term pricing is consistent with some observers' view that once the initial shock from global market volatility dissipates, bitcoin will regain ground.

"The U.S. slowdown looks clearly underway, and the Fed, behind the curve, will need to cut more aggressively than previously expected. U.S. [Treasury] yields and the dollar are consequently repricing lower, which is hugely bullish for bitcoin. Further, with China ramping up stimulus and liquidity injections, combined with a weaker dollar, global liquidity conditions are set to accelerate," the founders of newsletter service LondonCryptoClub said in Monday's edition.

"Bitcoin, for us, looks the most obvious trade for a Fed that is behind the curve and set to slash rates and ramp up liquidity. Strap in for a volatile few weeks, but don’t lose sight of the big picture," founders added.

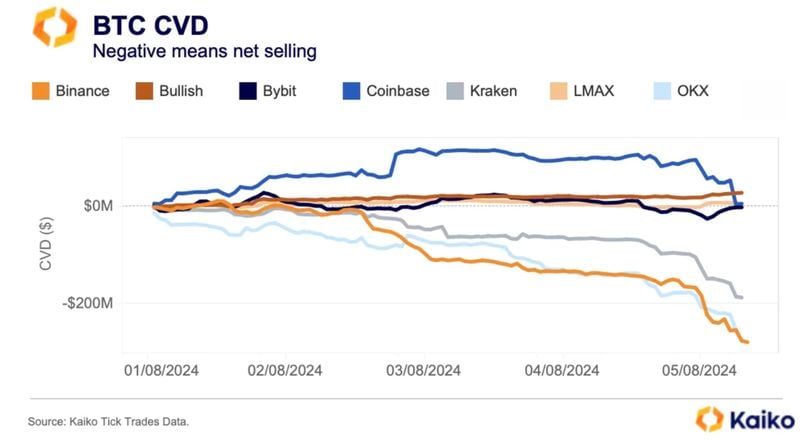

CVD suggests dip-buying. on U.S. exchanges

The rapid sell-off has been characterized by dip buying on platforms available in the U.S., such as Coinbase, Gemini and Kraken, according to cumulative volume delta (CVD) tracked by Paris-based Kaiko.

The CVD is the total difference between the volume of trades executed at the ask price (buying) and trades executed at the bid price (selling) over a specific period. A rising positive CVD indicates that buying volume exceeds selling volume, while a falling and negative CVD indicates otherwise.

The CVD on Coinbase, Gemini, and Kraken has mostly held positive since Aug. 1, indicating net buying pressure or bargain hunting during price losses.

"Interestingly, while offshore exchanges such as Binance and OKX saw strong selling since Friday, BTC’s cumulative volume delta (CVD) on most US platforms remained positive, suggesting that some traders bought the dip," Kaiko said in a note published Monday.

UPDATE (Aug. 6, 09:49 UTC): Adds dropped letter to headline.