-

Blockstream started a third round of sales for its tokenized note, BMN2

-

The round will be priced at $31,000 and give investors a share of the bitcoin produced by the mining company.

-

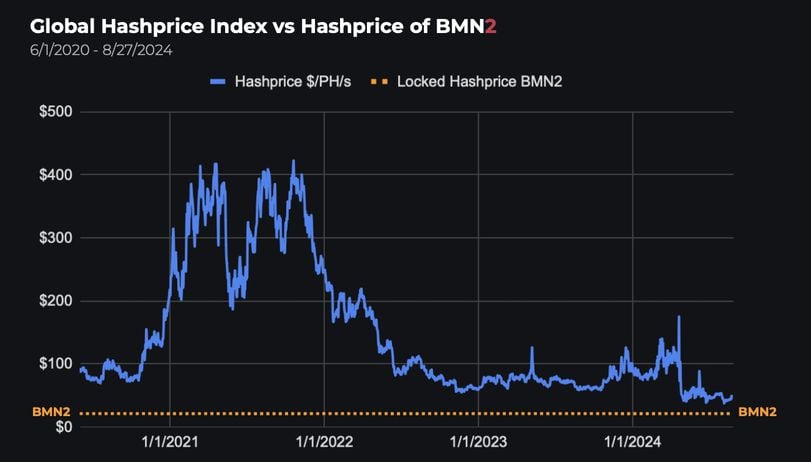

The hashrate-backed note allows investors to lock in the hashprice for up to four years, Blockstream said.

Blockstream Mining said it is opening a third round of investment for its hashrate-backed tokenized note, which gives participants a slice of the bitcoin (BTC) earned from the company's mining activities over the next four years.

Two earlier rounds of the BMN2 note raised a total of around $7 million. The third will be priced at $31,000 and give holders the bitcoin produced by 1 petahash per second (PH/s) of hashrate. The sale will last for three weeks, a company spokesperson said in an interview. Blockstream is targeting $10 million in investment for the latest round.

"Blockstream is able to offer mining for under 4.5 cents per kilowatt-hour (kWh), which is far below the industry average,” the spokesperson said. “Anyone investing in BMN2 will benefit from access to the most cost-effective mining around.”

The company, co-founded by legendary bitcoin developer Adam Back, is working with Stokr for the sale of the note.

Crypto markets are becoming increasingly financialized, and hashrate-backed contracts are not new. What’s unique about Blockstream’s note is its duration. Most contracts lock in the hashprice for up to 12 months, James Macedonio, Blockstream's SVP global head of mining sales and business development, said. BMN2, an EU-compliant security token, gives exposure to the bitcoin hashrate over a 48-month period.

Hashrate refers to the total combined computational power used to mine and process transactions on a proof-of-work blockchain and is a proxy for competition in the industry and mining difficulty. Hashprice is a mining metric that calculates revenue on a per terahash basis, and is computed using network difficulty, the bitcoin price, the block subsidy and transaction fees.

The advantage of buying Blockstream’s BMN2 note instead of buying hashrate futures from bitcoin mining companies is that investors are not exposed to counterparty risk or possible miner failures, and the price is locked in for four years, Macedonio said. Furthermore, the market hashprice adjusts quarterly, and is dependent on mining efficiency, and passes through risks such as energy price and counterparty risk, he added.

"With the bitcoin mining market currently experiencing historically low hashprice levels, BMN2 allows investors to strategically enter the market at an opportune time," the company said in a July release announcing the note.

In a report last month, Wall Street giant JPMorgan (JPM) noted that the hashprice is about 30% below levels seen in September 2022 and about 40% below the level before April's reward halving .

Investors in the note’s predecessor, BMN1, were mainly international family offices and funds in Europe, Macedonio said. While BMN2 is starting to see interest from U.S. institutions, the product is not being offered there yet, he said. Macedonio said many BMN1 investors rolled over their investment into BMN2.

BMN1 was highly successful. It “mined over 1,242 BTC and delivered returns of up to 103% over its three-year term,” Stokr said on its website. It is the "highest payout in real world asset (RWA) security token history," according to Arnab Naskar, co-founder and co-CEO of Stokr.

BMN2's first two investor rounds started on July 18 and ended Aug. 12. Anchor investors who committed over $500,000 in investment were given a discount and invested in series 1. Investors who rolled over their investment from Blockstream’s BMN1 note and new backers invested in series 2.

Money raised from the sale of the note is used to manage physical infrastructure and energy costs because Blockstream is responsible for producing the hashrate that backs the note. The company has mining facilities in Georgia, Montreal and Texas.

The tokenised note will trade on crypto exchange Bitfinex.