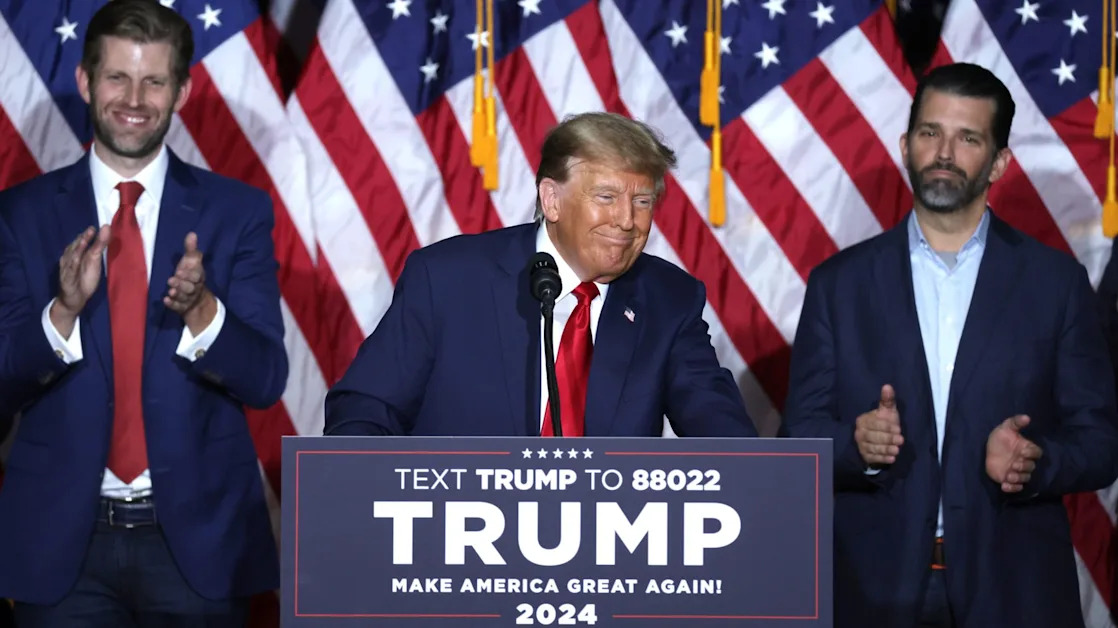

The S&P 500's ( ^GSPC ) surge to record highs since Donald Trump won the 2024 presidential election is showing no signs of stopping.

And Wall Street strategists have been quick to update their outlooks on where stocks may be headed next.

On Monday, Yardeni Research president Ed Yardeni wrote in a note to clients that he expects the S&P 500 to hit 6,100 by the end of 2024, about 2% above current levels.

Yardeni then sees the index reaching 7,000 by the end of 2025, 8,000 by the end of 2026, and 10,000 by the end of the decade. Previously, Yardeni told Yahoo Finance he'd seen the S&P 500 hitting 8,000 by the end of the decade.

"We're just seeing a more pro-business administration coming in that undoubtedly will cut taxes," Yardeni told Yahoo Finance. "And not only for corporations but also for individuals. Lots of various kinds of tax cuts have been discussed. And in addition to that, a lot of deregulation."

In his note, Yardeni wrote the market is showing early signs of "animal spirits" coming into play.

Key to Yardeni's call is a boost to his earnings estimates and margin projections for the S&P 500 due to Trump's policies. The earnings estimates assume Trump will "quickly lower the corporate tax rate from 21% to 15%."

Yardeni's decade-end forecast would mark a return of about 66% from current levels, or about 11% annually, roughly in line with the long-term average annual return of the S&P 500.

There are concerns, like sticky inflation readings , which may prompt investors to question whether the Federal Reserve will stop cutting interest rates.

And others, like the team at Goldman Sachs — which r ecently called for a 3% annual return for the S&P 500 over the next decade — have reasoned that, eventually, the bull market will turn into a bear.

"We aren't saying that a recession can't occur over the rest of the decade," Yardeni wrote in his note to clients. "However, we note that despite the significant tightening of monetary policy during 2022 through 2024, there has been no recession. Why should there be one over the remainder of the Roaring 2020s?"

Research from FactSet on Friday, showed the S&P 500 is already trading at 22.2 times 2025 earnings estimates. This is above the five-year average of 19.6 and the 20-year average of 15.8.

High valuations and frothy sentiment are among the reasons some have argued the market could be due for a correction, or at least more modest returns going forward.

But strategists often point out that high valuations on their own aren't often a reason to sell . "Multiples are likely to be elevated when investors believe that earnings can grow faster for longer because a recession is less likely in the foreseeable future," Yardeni wrote.

And as Evercore's Julian Emanuel wrote recently when making the case for the S&P 500 to hit 6,600 by June 2025, "Expensive has a history of getting more expensive and lasting longer with greater gains."

He added, "Exuberance lies ahead. President-Elect Trump will move fast on policy initiatives, and stocks will move fast in response."

Josh Schafer is a reporter for Yahoo Finance. Follow him on X @_joshschafer .