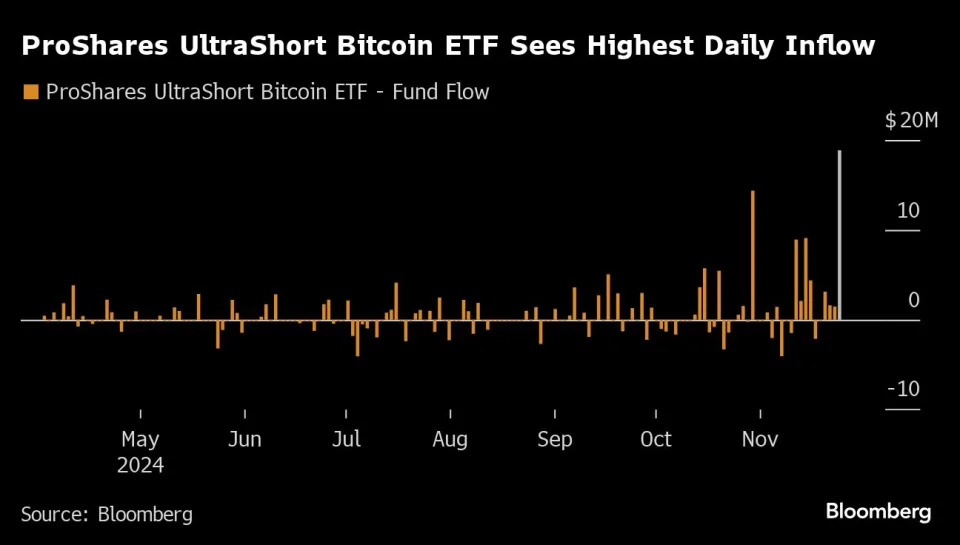

(Bloomberg) — A fund giving investors a way to turbocharge bets against Bitcoin notched its highest daily inflow in a sign that some investors consider the rally unleashed by Donald Trump’s election to the White House overdone.

The ProShares UltraShort Bitcoin exchange-traded fund ( SBIT ) aims to deliver twice the inverse daily performance of the token. It recorded a net inflow of $18.8 million on Monday, the largest since its April launch. Investors also piled into the ProShares Short Bitcoin ETF ( BITI ), which drew in about $23 million over the past two trading sessions, among the highest inflows this year.

Bitcoin has declined by around 7% in the past three days, as speculative fervor sparked by Trump’s presidential election victory cools. Spurred by optimism surrounding the President-elect’s pledges to embrace the digital-assets industry, Bitcoin last week rallied to within a few hundred dollars of the $100,000 mark.

Flows into funds shorting Bitcoin coincide with a $438 million outflow from a group of 12 spot ETFs that invest directly in the token — the third-biggest since their launch in January, according to data compiled by Bloomberg.

“Traders are hedging against potential downside risks,” said Nick Forster, founder of crypto trading platform Derive.xyz. “However, pullbacks like these are not uncommon in bull markets.”

Bitcoin was trading around $93,500 as of 9:54 a.m. Tuesday in London.