Online work marketplace Upwork (NASDAQ:UPWK) reported revenue ahead of Wall Street’s expectations in Q4 CY2024, with sales up 4.1% year on year to $191.5 million. The company expects next quarter’s revenue to be around $188.5 million, coming in 2.9% above analysts’ estimates. Its non-GAAP profit of $1.03 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Upwork? Find out in our full research report .

Upwork (UPWK) Q4 CY2024 Highlights:

“2024 was a record year for Upwork, with full-year revenue, GAAP net income and adjusted EBITDA reaching all-time highs,” said Hayden Brown, president and CEO, Upwork.

Company Overview

Formed through the 2013 merger of Elance and oDesk, Upwork (NASDAQ:UPWK) is an online platform where businesses and independent professionals connect to get work done.

Gig Economy

The iPhone changed the world, ushering in the era of the “always-on” internet and “on-demand” services - anything someone could want is just a few taps away. Likewise, the gig economy sprang up in a similar fashion, with a proliferation of tech-enabled freelance labor marketplaces, which work hand and hand with many on demand services. Individuals can now work on demand too. What began with tech-enabled platforms that aggregated riders and drivers has expanded over the past decade to include food delivery, groceries, and now even a plumber or graphic designer are all just a few taps away.

Sales Growth

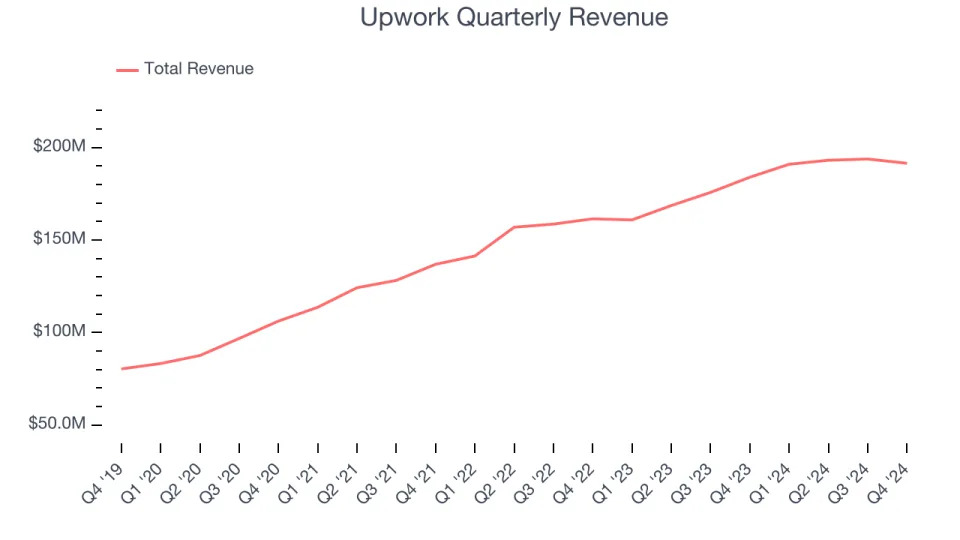

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, Upwork’s 15.2% annualized revenue growth over the last three years was solid. Its growth beat the average consumer internet company and shows its offerings resonate with customers, a helpful starting point for our analysis.

This quarter, Upwork reported modest year-on-year revenue growth of 4.1% but beat Wall Street’s estimates by 5.8%. Company management is currently guiding for a 1.3% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 1.8% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and suggests its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next .

Gross Services Volume

Gmv Growth

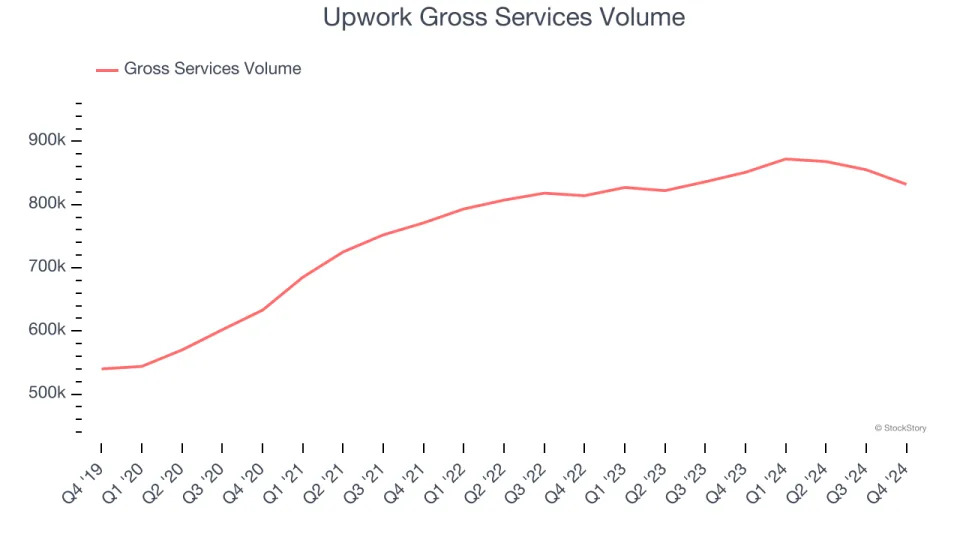

As a gig economy marketplace, Upwork generates revenue growth by expanding the number of services on its platform (e.g. rides, deliveries, freelance jobs) and raising the commission fee from each service provided.

Over the last two years, Upwork’s gross services volume, a key performance metric for the company, increased by 3% annually to 832,000 in the latest quarter. This growth rate is one of the lowest in the consumer internet sector. If Upwork wants to accelerate growth, it likely needs to engage users more effectively with its existing offerings or innovate with new products.

Unfortunately, Upwork’s gross services volume decreased by 19,000 in Q4, a 2.2% drop since last year. The quarterly print was lower than its two-year result, suggesting its new initiatives aren’t moving the needle for gmv yet.

Revenue Per Gmv

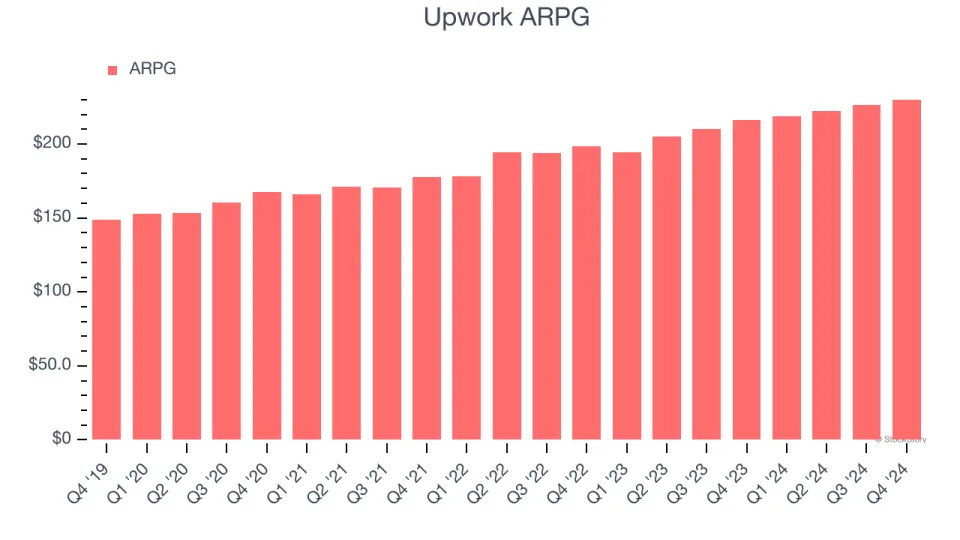

Average revenue per gmv (ARPG) is a critical metric to track for gig economy businesses like Upwork because it measures how much the company earns in transaction fees from each gmv. This number also informs us about Upwork’s take rate, which represents its pricing leverage over the ecosystem, or "cut" from each transaction.

Upwork’s ARPG growth has been impressive over the last two years, averaging 8.4%. Its ability to increase monetization while growing its gross services volume demonstrates its platform’s value, as its gmv continue to more each year.

This quarter, Upwork’s ARPG clocked in at $230.15. It grew by 6.5% year on year, faster than its gross services volume.

Key Takeaways from Upwork’s Q4 Results

We were impressed by Upwork’s optimistic EBITDA guidance for next quarter, which blew past analysts’ expectations. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its full-year revenue guidance slightly missed and its number of gross services volume fell short of Wall Street’s estimates. Overall, this quarter was mixed but still had some key positives. The stock traded up 5.1% to $16.34 immediately after reporting.

Is Upwork an attractive investment opportunity right now? We think that the latest quarter is just one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .