Electronics manufacturing services company Sanmina (NASDAQ:SANM) reported Q1 CY2025 results beating Wall Street’s revenue expectations , with sales up 8.1% year on year to $1.98 billion. On the other hand, next quarter’s revenue guidance of $1.98 billion was less impressive, coming in 4.4% below analysts’ estimates. Its non-GAAP profit of $1.41 per share was 2.5% above analysts’ consensus estimates.

Is now the time to buy Sanmina? Find out in our full research report .

Sanmina (SANM) Q1 CY2025 Highlights:

"We delivered solid financial results for the second quarter, with revenue at the high end and non-GAAP earnings per share exceeding our outlook. Our ability to adapt to the evolving environment is reflected in our consistent operating margin and strong cash generation," stated Jure Sola, Chairman and Chief Executive Officer.

Company Overview

Founded in 1980, Sanmina (NASDAQ:SANM) is an electronics manufacturing services company offering end-to-end solutions for various industries.

Sales Growth

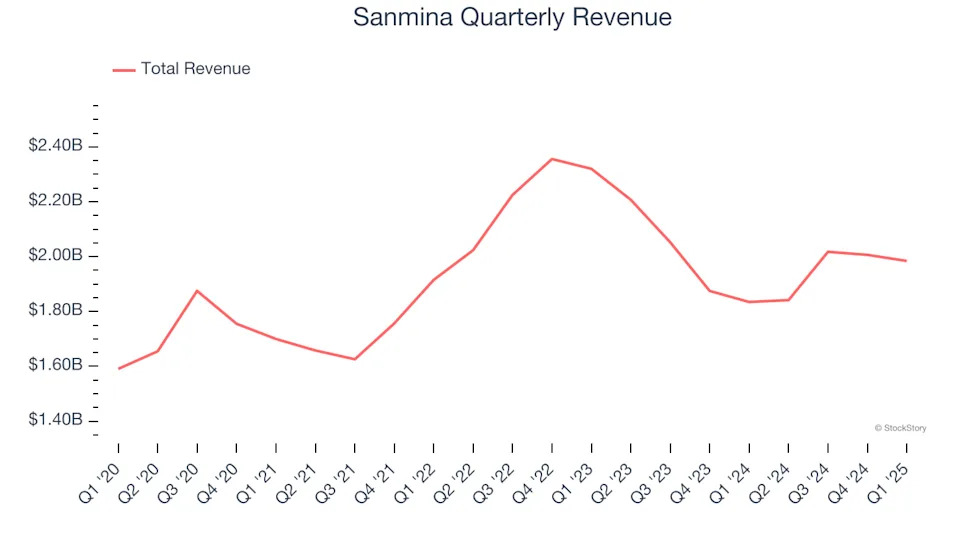

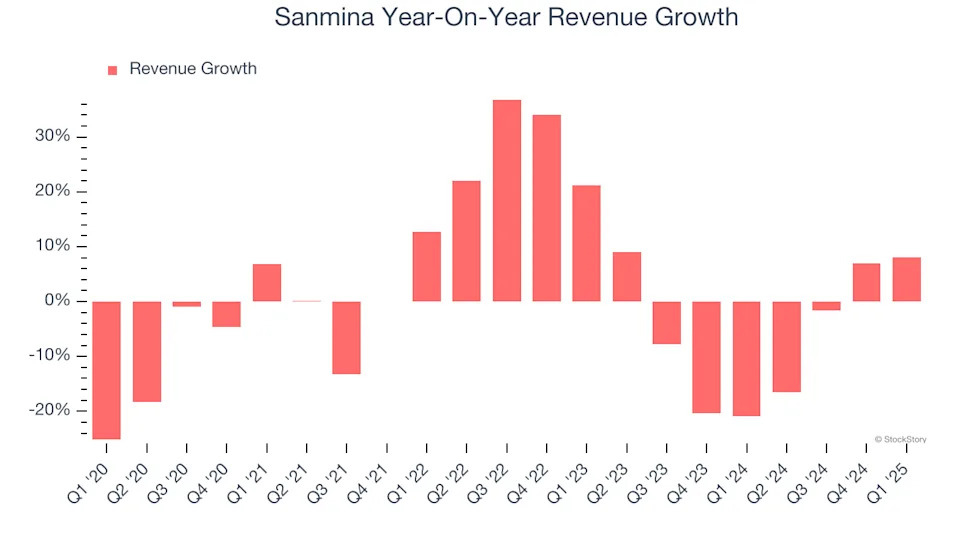

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Sanmina’s sales grew at a weak 1.3% compounded annual growth rate over the last five years. This fell short of our benchmarks and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Sanmina’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 6.2% annually. Sanmina isn’t alone in its struggles as the Electrical Systems industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

This quarter, Sanmina reported year-on-year revenue growth of 8.1%, and its $1.98 billion of revenue exceeded Wall Street’s estimates by 1%. Company management is currently guiding for a 7.3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 8.1% over the next 12 months, an improvement versus the last two years. This projection is above the sector average and implies its newer products and services will catalyze better top-line performance.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. .

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

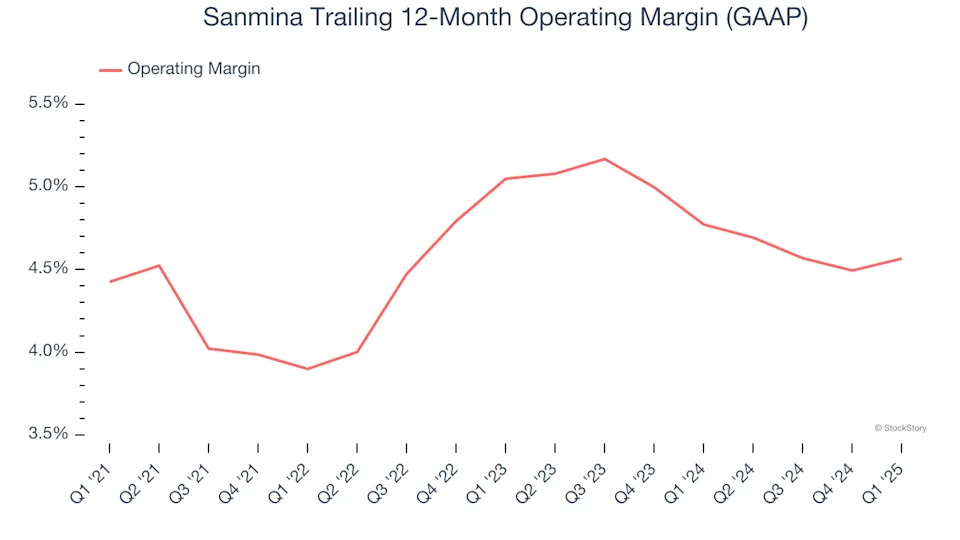

Sanmina was profitable over the last five years but held back by its large cost base. Its average operating margin of 4.6% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Analyzing the trend in its profitability, Sanmina’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Sanmina generated an operating profit margin of 4.6%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

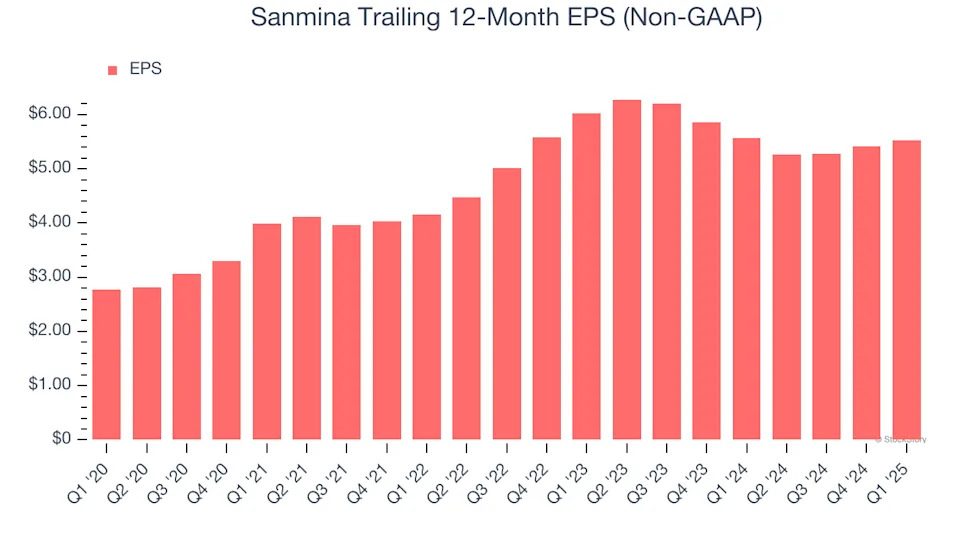

Sanmina’s EPS grew at a spectacular 14.8% compounded annual growth rate over the last five years, higher than its 1.3% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t expand.

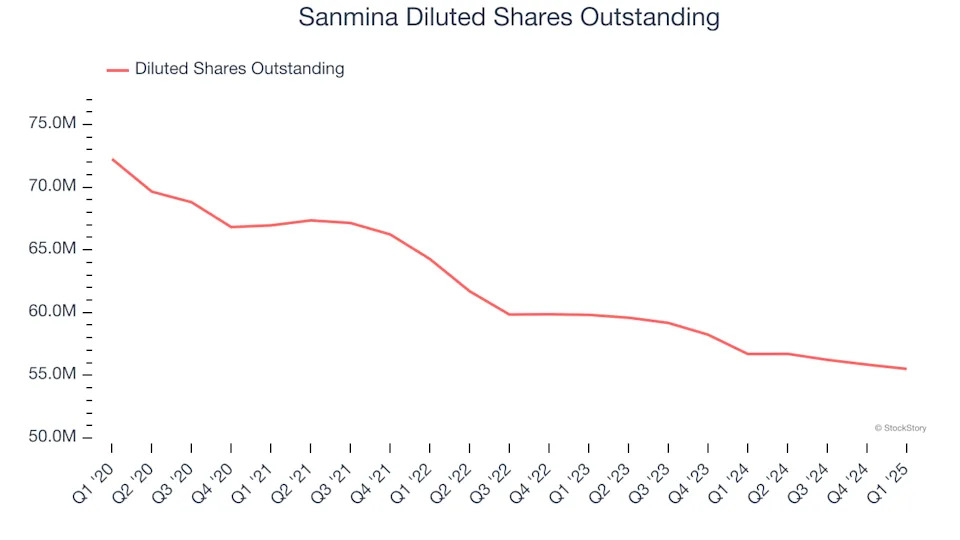

Diving into Sanmina’s quality of earnings can give us a better understanding of its performance. A five-year view shows that Sanmina has repurchased its stock, shrinking its share count by 23.2%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Sanmina, its two-year annual EPS declines of 4.2% mark a reversal from its (seemingly) healthy five-year trend. We hope Sanmina can return to earnings growth in the future.

In Q1, Sanmina reported EPS at $1.41, up from $1.30 in the same quarter last year. This print beat analysts’ estimates by 2.5%. Over the next 12 months, Wall Street expects Sanmina’s full-year EPS of $5.53 to grow 20.5%.

Key Takeaways from Sanmina’s Q1 Results

It was encouraging to see Sanmina beat analysts’ adjusted operating income expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its EPS guidance for next quarter missed significantly and its revenue guidance for next quarter fell short of Wall Street’s estimates. Overall, this was a mixed quarter. The stock remained flat at $80.73 immediately after reporting.

Big picture, is Sanmina a buy here and now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free .