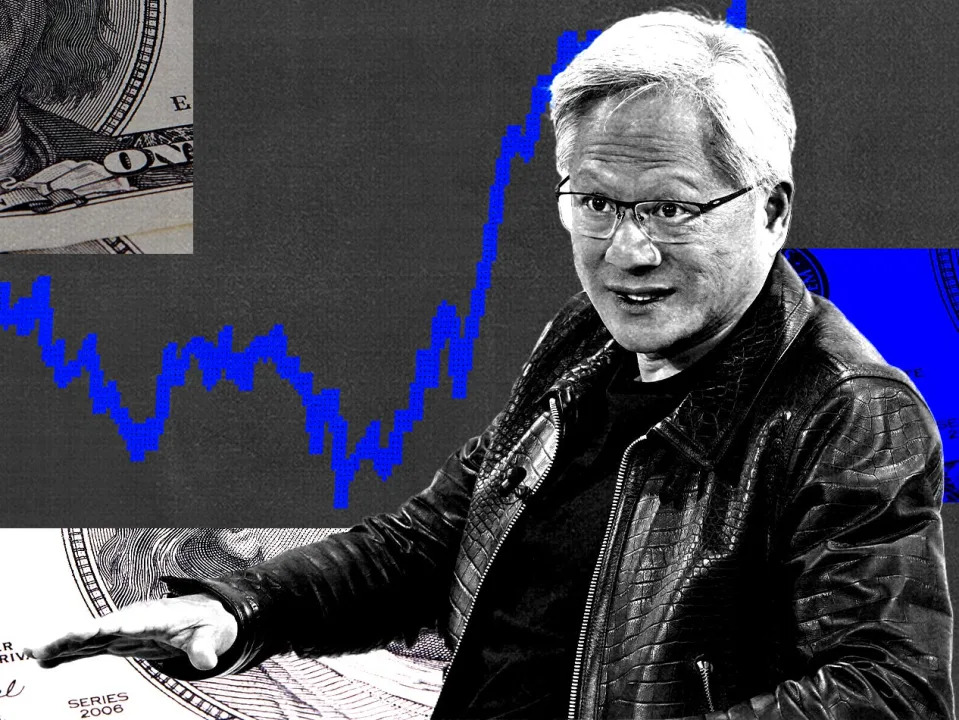

Nvidia's stock is flashing a big "sell" sign to investors, according to the veteran strategist Bill Blain.

Blain, the founder of Wind Shift Capital and a longtime financial strategist, pointed out in a note on Tuesday that Nvidia's sky-high valuation has made many of its employees very wealthy. He referred to a recent poll that found 40% of those who worked at Nvidia had a net worth between $1 million and $20 million, while 37% had a net worth of over $20 million.

Blain said that leaves less than a third of Nvidia's staff with "any real daily financial pressure upon them."

"Do you think that poor quarter of Nvidia peons are really going to bust their guts for guys who are already rich and highly motivated to protect their wealth and position? Do they think Nvidia will rise a further 700%? Will they be happy remaining exceedingly poor relative to their peers and bosses? Or is it more likely the enormous wealth in the office means the poorer but still highly motivated staff are going to figure their wealth chances will be better elsewhere?" Blain wrote.

Nvidia's enormous valuation could also signal a peak in the broader stock market, Blain said. While investors are pricing in ambitious rate cuts over the next year, policy easing will likely be "limited" from the Fed, he said, adding that he believed 4%-6% interest rates would constitute the market's new normal.

"Some folk think lower interest rates, as promised by the Fed later this month, spell joy unlimited for markets. (I think it may still be a sell-the-fact moment.)" Blain said. "And many, including myself, believe a new long-term economic cycle could reverse the last 40 years of diminished inflationary pressures."

Markets began their current long-term cycle in 1980s as inflation steadily decreased following a difficult period of inflation during the prior decade, Blain said. He suggested that markets could enter a fresh cycle as soon as 2025, pointing to inflationary pressures stemming from geopolitical tensions, commodities, and the mounting US debt balance.

"I just found my best reason to sell Nvidia, confirming we're at the top of the market. What might come next? How about 20-years of rising inflation, rising rates, and a global commodities super-cycle as nations scrabble to secure future strategic resources?" he added.

Other strategists have warned of continued inflationary pressures, despite price growth trending downward from its peak in 2022. Inflation could see a resurgence , BlackRock strategists previously predicted, pointing to the risk of a big spike in oil prices, as well as demand outpacing supply in the US economy.

Read the original article on Business Insider